The second quarter of 2022 was characterized by turbulent market conditions in traditional and digital assets alike. However, this three-month period also presented an opportunity for us to demonstrate the robustness of our risk management framework as we avoided exposure to high-risk, overleveraged parts of the digital asset ecosystem.

Despite the market backdrop, this quarter saw us successfully launch our long-awaited mobile app for iOS and Android alongside unveiling our Referral Program and announcements of several partnerships that continue to add perks to Yield App membership. We are pleased to outline all our achievements of Q2 2022 in our latest quarterly report.

Dear valued customer,

Over the past quarter, financial markets have been rocked by macro and microeconomic pressures that have led to sell-offs across asset classes. During these turbulent times, focusing on capital preservation and following a strict risk management process has been more important than ever.

At Yield App, capital preservation has been at the core of our strategy since day one. Over the past two years, we have developed a robust proprietary risk model which has allowed us to anticipate and navigate the recent market downturn and ensure the safety of the assets held on our platform. Continuously refining this capability remains our key focus going forward.

As a result of careful planning and thorough due diligence, Yield App is in a solid position to take advantage of the current market conditions. In the coming months, we will continue to build and innovate, as we prepare for the next stage of our growth.

Regardless of the economic backdrop, our valued customers remain our highest priority. Yield App combines industry-leading security, compliance with the highest regulatory standards, and strict corporate governance to ensure you can sleep soundly at night, knowing your assets are safe with us.

Equally, we are aware of the value of consistent and timely communication and personalized support. Our Relationship Management team remains at your full disposal 24/7 to answer any queries and provide support with any matter, however small.

We are honored that you have selected us as your trusted digital wealth partner and look forward to serving you for years to come. Thank you for your continued support.

Yours sincerely,

Tim Frost

CEO of Yield App

Portfolio Management

Overview

During the second quarter of 2022, several events destabilized the digital asset marketplace, causing a spike in volatility and liquidity issues in parts of the ecosystem. The collapse of the UST stablecoin and the Terra ecosystem, as well as the insolvency of Three Arrows Capital (3AC), highlighted the importance of thorough due diligence when it comes to digital asset investment strategies.

In the lead-up to these events, we maintained our long-term strategy focused on capital preservation and conducted thorough risk assessments on all DeFi pools and external managers before deploying our assets with them. This due diligence allowed us to avoid any exposure to UST or 3AC, which subsequently caused some peers to face severe liquidity issues. Throughout the recent market turmoil, Yield App has remained fully liquid and has honored all withdrawals in a timely manner.

During Q2, we increased our allocations to several of our market-neutral strategies, run by external managers with proven track records who have passed our rigorous risk assessment. We now deploy assets across a total of 17 external strategies. In addition, we rotated positions across 14 approved DeFi market-neutral pools.

Employing a combination of DeFi and CeFi arbitrage strategies allows us to deliver higher yields than would have been possible via a single strategy, while ensuring we remain market neutral and significantly reducing the risk associated with our overall portfolio. Furthermore, we have never resorted to lending out our customers’ assets to increase the yields we offer, and have avoided allocating to illiquid strategies. As a result, we have avoided any exposure to the risks associated with unsecured lending, ensuring our customers’ assets remain secure throughout the market turmoil.

Capital allocation

DeFi strategies

Further to the update provided in Q1, allocation sizing within DeFi has continued to reduce month-on-month as opportunities inside our acceptable spectrum of risk (guided by our internal risk modeling) have narrowed. The high level of volatility within the market over the past weeks has unfortunately slowed protocol-based liquidity incentives as the underlying value of rewards has been significantly hampered in the market downturn.

While the scope of opportunity for capital allocation in DeFi is currently limited, we expect to re-establish our asset base in DeFi once opportunities arise that meet our internal thresholds, ensuring client asset security remains the number one priority above all else.

Although market opportunities for capital deployment in DeFi have contracted, the team continues to innovate enhanced tooling for optimizing performance and security for navigating the decentralized finance landscape.

The enhanced risk model engine continues to progress and the in-house portfolio management system (PMS) specifically designed for a 360-degree view of yield farming analysis is nearing completion of the pilot level feature set. This provides streams of curated, position-focused data directly from the blockchain straight to the hands of our portfolio and risk managers block by block, enhancing their ability to adjust for changing market conditions and movements.

Third-party strategies

Yield App allocates customers’ assets through a combination of DeFi strategies and external liquid alpha market neutral managers to create a diversified source of yield. Our external manager allocation is heavily geared towards two strategy types: liquidity provision and systematic trading.

Liquidity provision strategies create a relatively stable and uncorrelated return profile, as they are directionally agnostic. These strategies capitalize on highly fragmented markets, with examples including market-making and arbitrage.

Our systematic trading strategies utilize market signals to inform their positions across multiple strategies. The strategies provide attractive alpha given the inefficiency and volatility across our base assets. These strategies are mostly short-timeframe (hours/days) and use limited or no leverage. Examples include statistical arbitrage and relative value (RV).

READ: How does Yield App pay its APYs?

During Q2, we rotated further out of DeFi strategies, as the size and opportunity set of the DeFi space has shrunk, while opportunities in alpha-generating market neutral strategies have increased as a result of the prevailing market volatility. At the end of Q1, approximately 50% of the total portfolio was deployed into low-risk market neutral systematic trading and liquidity provision strategies.

We have seen particularly attractive opportunities in a variety of arbitrage strategies, which perform well during times of increased price volatility. These include liquidation arbitrage and triangulation arbitrage. In terms of performance during the quarter, our volatility arbitrage, relative value and market-making strategies held up particularly well.

Risk management

We never deploy assets into new protocols or external funds without first conducting a rigorous due diligence process. All protocols and external managers must pass our strict thresholds and demonstrate proven track records. Just 6% of external managers we consider pass our stringent risk assessment criteria.

Our DeFi team utilizes an internal proprietary risk model that focuses on four pillars of security. This model analyzes all aspects of market exposure against 135 measured variables compiled from historical data to ensure outperformance over the medium and longer term. More information about our due diligence process can be found in our blog article, linked below.

READ: How does Yield App conduct its due diligence?

Our allocation to external managers will never make up more than 20% of their total AUM if we are invested alongside other LPs, and the same goes for any single protocol. This ensures our strategies remain highly diversified at all times, minimizing volatility and reducing the risk of unexpected loss to a minimum.

Market outlook

We are well positioned to take advantage of the current market volatility and see the turbulent market backdrop as a tremendous opportunity to generate yields on digital assets. At the same time, we are dedicating our efforts to continuing to build our world-class portfolio management team and increase our capacity to comfortably deploy $1 billion and beyond.

As such, our portfolio management team is busy conducting due diligence on three new strategies, which will further increase diversification across our portfolios in the coming months and allow us to take on more capital as markets recover.

Our focus, however, remains on our existing customers. We will never accept additional capital if it were to negatively impact returns for existing customers, and we have made the decision to turn down allocations from potential large clients in the past. Throughout the remainder of 2022, we will continue to focus on delivering the best possible yields to our customers in a sustainable manner, with capital preservation always at the heart of our strategy.

READ: How to spot if a crypto yield opportunity is “too good to be true”?

On the DeFi side, whilst Yield App does not utilize on-chain lending protocols like MakerDAO, Compound and Aave to generate yield, it is important to recognize these core pillars of DeFi have continued to operate seamlessly without disruption during the recent weeks of high volatility, withstanding unprecedented stress tests on protocol infrastructure and liquidation engines.

The ability of core protocols to withstand this type of stress has undoubtedly reinforced the evolving value proposition of DeFi as a whole, solidifying these decentralized applications as robust financial instruments. In our view, the turmoil we have seen in the digital asset market will create a more mature ecosystem, ultimately leading to more sustainable risk-adjusted returns and opportunities.

Product development

Mobile app launch

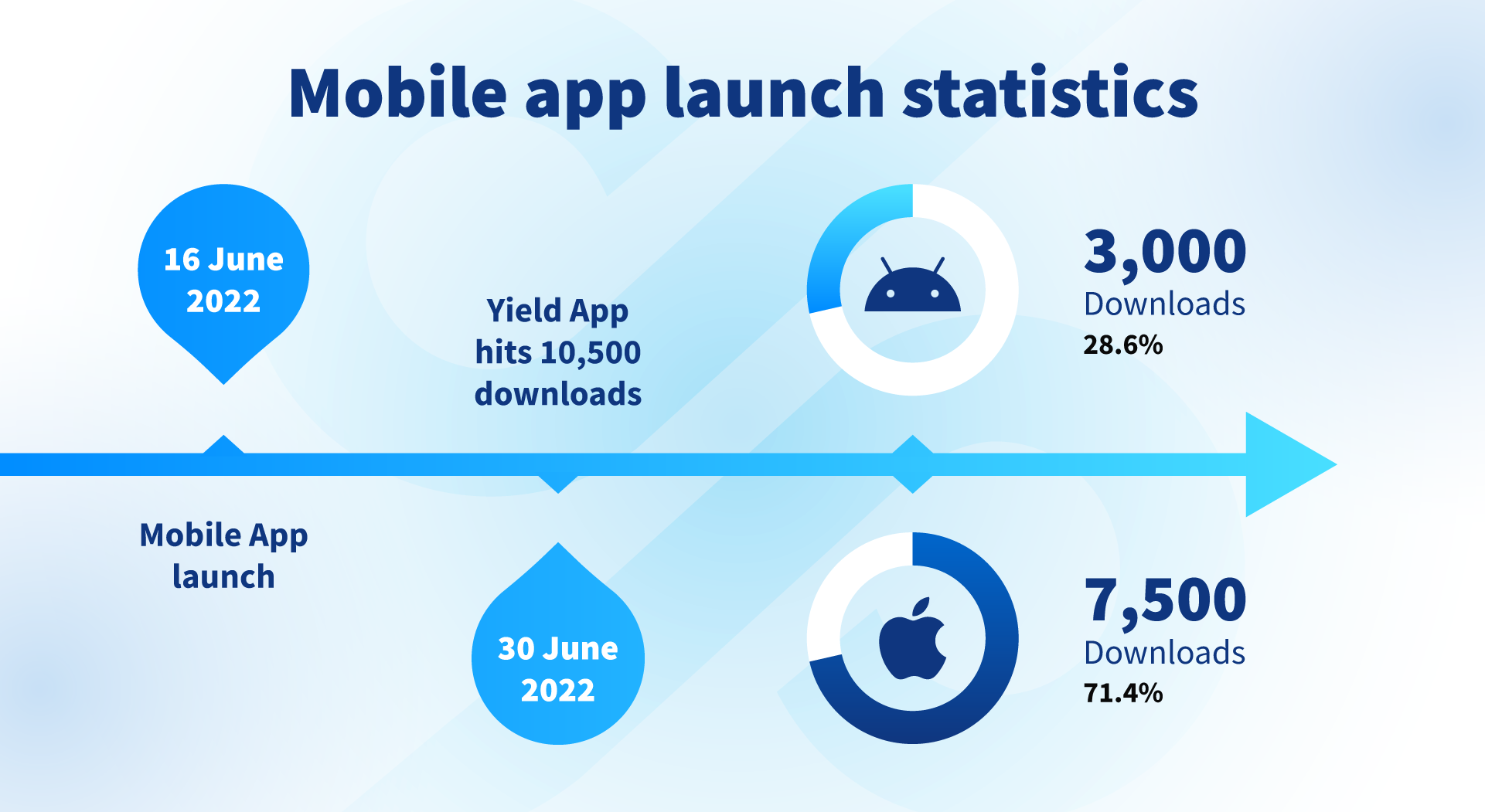

On 16 June 2022, Yield App launched its long-awaited mobile app for iOS and Android after extensive testing by a select group of community members. Our mobile app includes all the same functionalities as our intuitive and easy-to-use web platform, as well as simpler login options and enhanced biometric security via fingerprint or Face ID.

In the two weeks between the launch of the mobile app and the end of Q2 2022, we saw 7,500 downloads of our app on iOS and 3,000 downloads on Android.

The launch of the mobile app was a key milestone for Yield App, as we continue on our mission to provide our customers with all the tools necessary to access digital wealth opportunities efficiently and effortlessly.

READ: Yield App makes earning on your crypto effortless with mobile app

Future plans

In the coming months, we plan to focus our product development on several key areas that have been requested by our customers and that we believe will significantly enhance their user experience going forward. This includes the following:

Fixed-term earn products

In Q3, we will introduce new fixed-term earn products for ETH and stablecoins to provide our customers with greater flexibility in the way they choose to earn on our platform. The existing instant-liquidity earn portfolios will still be available. The lock & earn portfolios will be an additional option to provide more flexibility to those customers who would like to earn higher rates with longer lock-up periods.

Fiat on-ramp solution

We are working on a simple and cost-effective native solution to on-ramp Euros and Pounds Sterling (GBP) onto the Yield App platform. Currently, we are using a third-party application (OnRamper), which involves higher fees. The new solution will be less costly for our customers.

Increased swap limits and lower costs

Currently, Yield App customers can convert up to $5,000 per pay across all assets available on the Yield App platform. In the near future, we are looking to significantly increase this limit, while lowering the costs of conversion, ensuring our digital wealth platform caters to all our customers’ needs within one intuitive platform.

Yield App API

The coming months will see us working on developing our own read-only Application Programming Interface (API). An API is a program that enables one software application to interact with another. API integration will allow our customers to query certain data endpoints from their Yield App account.

READ: Find out more from our blog, which we will continue updating as our product plans progress.

Regulatory landscape

While the current market conditions are a perfect example of self-regulation and market self-actualization, regulators across the globe have rallied towards defining new pieces of legislation as they try to put in place a framework to oversee a decentralized system that is the backbone of the digital asset financial ecosystem.

In the past couple of months, we have witnessed jurisdiction after jurisdiction passing new regulations focused on consumer protection, security, reporting, and transaction monitoring, including Travel Rule provisions, risk assessment and due diligence, transparency and communication.

Estonia

On 15 March 2022, the Estonian FIU passed an amendment to its AMLA aimed at creating an environment compliant with FATF 2018 Recommendations, EU AMLD5 and AMLD6 and internal country strategies.

At Yield App we have already integrated the requirements into our Compliance and Governance Framework. As such, this exercise was one of alignment and acceleration of integration of a Travel Rule solution we had identified as most suitable to our operations.

Our goal is to maintain industry best standards in Risk, Compliance and Governance at all times. Our Compliance Team is continuously scanning the international legislative landscape for regulatory changes and trends and consistently amending Yield App policies to not only comply with existing standards but achieve full alignment with applicable local and international regulations going forward, thus ensuring overall process and operations compliance.

EU

The end of June 2022 has been quite revelatory for the operations of Crypto Asset Services Providers (CASPs) within the EU. Long-awaited MiCA and TFR regulations (“New Regulations”) have finally completed the discussion/negotiation rounds and EU lawmakers are now in a position to translate these into enforceable frameworks. After this, the EBA will have the task of drawing up guidelines to assist CASPs in their adoption and implementation of these New Regulations.

While DeFi/Web 3.0 provisions are not included in the New Regulations, we can expect discussions on this topic to start soon and we will remain engaged with relevant agencies through our advocacy groups to ensure we have a voice in the shaping of those policies.

The New Regulations are not expected to be implemented until late 2024, but EU and local regulators have unofficially commented that the following period should be used by CASPs to understand and start provisioning for their implementation.

International

Across the world, we are seeing evidence of movement toward creating a more secure, regulated, inclusive environment for Virtual Asset Service Providers (VASPs). With Singapore granting their first pure crypto license, the US publishing two separate legislation proposals, Abu Dhabi proposing a new DeFi-focused piece of legislation for consultation, Italy adopting specific crypto regulation, the Central Bank of Spain granting permissions to CASPs to legally operate in Spain under local regulation, and Nigeria taking huge strides towards adoption of virtual currencies; there are signs that the value proposition offered by digital assets is here to stay and that they already form a significant component of the financial industry.

Denomination, acronyms, legislation, inclusion, adoption. This metalanguage is on everyone’s minds across the world. We are looking at a new now: a decentralized financial ecosystem, designed to perform as an independent and separate infrastructure which is now slowly but surely becoming integrated into an incumbent financial system that has taken more than a century and countless challenges including several financial crises to mature.

Marketing and communications

Overview

During Q2, we witnessed a breakdown of trust in the industry as several players in the ecosystem encountered liquidity issues and insolvencies. Our work at Yield App during this time of turmoil has been focused on customer retention and on communicating to our customers the nuances of our business operations and how we are navigating the current market.

For that purpose, our key team members have delivered numerous presentations at major industry events. During these presentations, we sought to shed light on Yield App’s rigorous due diligence process, as well as the strategies we utilize to continue producing sustainable yields in a risk-averse manner, despite the shrinking size of the digital asset market.

We focused on offering the best service in the space to our valued customers by holding open conversations with our community through a series of AMAs in several languages, garnering valuable feedback from the community. In addition, we implemented a simple and intuitive live-chat solution on our website to respond to our customers’ and visitors’ questions 24/7.

We will continue to develop our high-level educational content and maintain our transparent narrative in the upcoming months with an ever-growing focus on our customers' concerns. We see this approach, along with our conservative asset management framework focused on risk preservation, as the most appropriate strategy in the current market conditions.

Key campaigns

Referral Program

On 13 April 2022, we unveiled our Referral Program, allowing Yield App customers to refer their friends and earn between 100 YLD and 1,000 YLD each per referral. The program has been successful so far in helping us grow our customer base. Since the launch of our Referral Program, more than 4,600 new customers have been referred to Yield App.

Mobile app launch

Our long-awaited mobile app was launched to the public on 16 June 2022, following several weeks of testing by a select group. The launch was accompanied by a blog announcement, press release distribution, and a special newsletter, as well as a full social media campaign, and garnered positive reviews from our community members.

New website

The second quarter saw us revamp our website, opting for a fresh new look that showcases the new app and introduces a number of other new informative features. This includes a brand-new Security page, a Careers page listing our open positions, and an updated rewards calculator based on our new V2 Tier system.

Free withdrawals for Diamond Tier customers

During Q2, we focused on bringing value to our Diamond Tier customers through additional perks. All our Diamond Tier customers are now able to enjoy three free withdrawals per month, offering a truly premium end-to-end experience.

Integrations and partnerships

MyReality / Sandbox

In April, we announced our partnership with MyReality DAO, the best-known scenario building and game development team in The Sandbox. This partnership saw us stake our claim on The Sandbox with a massive 4x4 plot of land right in the center of this virtual world, where we plan to build the Yield App Tower. This will be a space for virtual events, experiences and games for all our valued customers in the metaverse.

Koinly partnership

In June, Yield App announced that our CSV files are now fully integrated with Koinly, a leading digital asset tax reporting software. As part of this campaign, we offered all our customers an exclusive 20% discount on their Koinly tax reports via a discount code sent out in our weekly Yield App Essentials newsletter.

Crisp integration

During Q2, we integrated Crisp, a multichannel messaging solution, into our website, helping us ensure that we offer the best customer support in the industry. Existing clients and prospective customers can ask all their questions via a 24/7 chat on our website and receive timely responses and tailored support.

Unstoppable Domains

In June 2022, we announced a partnership with Unstoppable Domains (UD), a leading provider of NFT domains. As part of this partnership, all Silver Tier customers and up received a $40 voucher to purchase a UD NFT domain, while Diamond Tier customers could claim an additional $100 voucher.

Our collaboration also saw UD host an AMA session with our CMO Adrien Geneste on their Twitter Space on Friday 8 July, while we published a video interview and written Q&A with Sajjad Rehman, UD’s Head of Europe.

Trustpilot

This quarter saw us launch our consumer page on Trustpilot to prove our quality to the world. As of the end of Q2, we have 92 reviews with an average rating of 4.7 (excellent). You can see our reviews and leave your own by heading here.

Community and social media

In the past three months, our community and social media channels continued to show strong activity across all global and regional channels. The total number of followers currently stands at more than 105,000.

We continue to focus on quality over quantity, putting our efforts into developing the same high-quality, informative educational content we have produced since launch. We are dedicated to transparency across our social media content and within our community interactions as we foster engagement and learning across our entire business landscape.

As part of this, we have continued to prioritize engagement with active Yield App customers. In Q2, our engagement rate increased slightly to 4% as a result of this strategy.

The coming months will see us expand the types of content we share across our channels, including branching out into videos thanks to the recent hire of a Motion Graphics Designer (see Key Hires section for details), as well as infographics and other visual ways to represent our educational and insightful content.

Events

During Q2, Yield App sponsored and attended several key industry events in Europe, the US, and Asia as we focused on building awareness of our brand in the wider digital asset ecosystem.

Sponsored

In April, we sponsored Bitcoin Miami, one of the biggest blockchain conferences in the US, which was attended by members of our team from all over the world, including our CEO Tim Frost. You can find a recap of the event here.

Later that month, our CMO Adrien Geneste and several other members of the Yield App team attended the two-day Paris Blockchain Week Summit, where we made more than 300 industry contacts, including our partners at Unstoppable Domains. Here is our recap of the summit.

The quarter also saw us sponsor Blockchain Week Rome, attended by our CIO Lucas Kiely, where he delivered a well-received presentation (more on this later). All the highlights from this event are in this blog.

On Thursday 30 June, our Head of Community Management, Sapta Munggaran, made an appearance at BlockJakarta 2022, a leading crypto event in Indonesia organized by Black Arrow. We shared insights from this event in one of our weekly newsletters.

Attended

Outside of event sponsorship, we also ensured that our team members attended as many smaller local events as possible, to ensure a global presence for our team and brand representation at all times.

In Q2, Yield App’s Europe-based team members attended the Tomorrow Conference 2022 in Belgrade (13-15 May), Crypto Expo Milan in Italy (23-26 June), and the European Blockchain Convention in Barcelona (26-28 June).

In Asia, our recently hired Asia Relationship Manager, Hsu Li, went to the Tainan Blockchain International Fair in Taiwan (24-25 June), while our CEO Tim Frost attended Consensus in Austin, Texas (9-12 June) as well as the Goldman Sachs Summer Digital Asset Conference held on 23 June in New York.

Global media coverage

Yield App was mentioned in the media in 27 countries in total during Q2. North America, East Asia and the Indian Ocean accounted for 78% of total coverage, with Canada and Taiwan taking the two top spots. Overall, Yield App garnered 357 mentions in the media during the quarter, appearing in approximately 486 million article views worldwide.

The particularly strong coverage in Taiwan was the result of our Asia-focused team’s impressive work synchronizing major product updates and press releases on mainstream news media outlets in the country, including Yahoo Taiwan, Sina Taiwan, and Pchome Online, gaining massive exposure in this region. As a result, Pchome was our top publication during the quarter.

Thought leadership

During Q2, we focused on developing a strong presence for our executives as thought leaders in their respective fields through presentations at events and podcasts. Our CIO Lucas Kiely delivered a well-received speech during the Blockchain Week Rome event in May, entitled: “High Yielding Opportunities – From what point is it too good to be true?”. The full video can be watched here.

In June, Lucas also took part in an in-depth discussion with Henri Arslanian regarding recent market developments in the digital asset space. He discussed the events surrounding crypto lending platforms and the repercussions he expects to see across the entire industry. You can watch the full interview here.

Our CEO Tim Frost appeared on The Playbook podcast with David Meltzer, where he discussed his previous experience building fintech start-ups and the advantages of a flexible and adaptable team. This episode can be found on Spotify.

Tim also shared his thoughts on the future of the DeFi space, the productive bear market prompted by the Terra/LUNA collapse, and other timely topics in his blog posts for TalkMarkets. In addition, he shared his expert views in articles across global media outlets, providing insightful quotes to CoinDesk, Australian Financial Review, and CoinJournal to name a few.

In Asia, Yield App continued to develop a strong presence via in-depth interviews with our executives published through Blockcast.it and BlockTempo. Our COO & CFO Justin Wright and CMO Adrien Geneste shared their insights regarding DeFi’s development and institutional adoption of crypto, respectively, while our CEO Tim Frost’s column covering the collapse of UST was also quoted in different Chinese editorial articles.

Q2 also saw our new Asia Relationship Manager, Hsu Li, featured on the first Chinese podcast with Grenade, talking about Yield App’s bear market strategies. He also appeared as a guest in Huobi Tech’s Twitter Spaces panel discussion.

Corporate business development

Corporate clients

We continued to build out our proposition as a secure treasury for corporate and institutional assets during Q2. We now count over 100 global corporate and institutional clients as of the end of Q2, spanning Europe, Asia and APAC. Corporate and institutional clients are attracted by Yield App’s conservative investment risk policy aimed at capital preservation combined with our personal approach delivered through our dedicated Relationship Managers across multiple geographies and languages.

Stablecoins remain the preferred digital asset for our corporate treasury management clients due to their lack of volatility. Some 24% of corporate and institutional assets are held in BTC, while more than 13% is allocated to ETH, showing a slight preference shift from ETH to BTC within these assets. To facilitate the seamless transition from fiat into digital assets, we provide assistance to these clients with conversions from fiat into digital currencies by way of over-the-counter (OTC) trades executed through regulated financial institutions.

Relationship Manager program

Our highest Tier members have access to our exclusive Relationship Manager (RM) program, which provides a dedicated support channel and helps us further enhance the personalized service we offer to our clients. We have now assigned a Relationship Manager to all of our VIP clients who hold a balance valued at $100,000 equivalent or more on the Yield App platform, which accounts for 82% of our total asset base.

Our Relationship Managers are based across the globe, speaking more than 16 different languages to provide a bespoke experience and tailored support to our most valued clients.

Our RM team is in constant communication with our DeFi and portfolio managers to ensure that all our VIPs have access to the most accurate and up-to-date information. During a quarter that has seen a lot of uncertainty set in across the broader market, our RMs have been there for our clients to answer all queries. Beyond just emails and video calls, our RMs have had the opportunity to meet many of our clients at blockchain events worldwide.

Some of the services offered by our RMs include:

Assisting in setting up corporate accounts and self-managed super fund accounts (Australia)

Meeting with clients’ extended networks to answer questions one-on-one

Ensuring quick and personalized responses to any support inquiries

Considering feedback and discussing future plans for Yield App's services

Key hires

During Q2 2022, we continued to hire world-class talent to build out our capabilities as a trusted digital wealth manager. One of our key hires was Akash Mahendra, who joined our DeFi team as a Portfolio Manager as we continue to build out our expertise in this area.

Akash’s career spans the FinTech industry, venture capitalism, risk analysis, and law. Alongside his role as Portfolio Manager at Yield App, he also serves as CIO for DAO Capital, a private Web3 investment fund. Akash has served as a strategic advisor and consulted for various projects and institutions such as Steady State, Australian Securities and Investment Commission, and LawRight Queensland, and also has significant experience as a litigator at Queensland’s Department of Justice.

We continued to grow our Relationship Manager team with the hire of Hsu Li, who is responsible for our clients based in Asia. Originally from Taiwan, educated in the US, and having developed his career in China, Hsu is perfectly positioned to help us serve our Asia-based community, including Chinese-speaking clients.

Towards the end of the quarter, our marketing team was enhanced with the hire of Sergio Lombardo as Motion Graphic Designer. Before joining Yield App, Sergio worked as a freelancer for international clients from different industries but found his vocational path in the recent NFT explosion. Sergio will significantly enhance the content we produce going forward with video content and help the design team with all aspects of their work.

We continue to seek outstanding talent to add to our already world-class team as we focus on building and preparing our business for future growth.

Managed assets and customers

Between the end of Q1 2022 and 30 June 2022, Yield App’s managed assets in US dollar terms fell from $552 million to $233 million. This change should be viewed in the context of the wider digital asset market backdrop. The US dollar value of Bitcoin is down 56% over the three-month period, while Ether has lost 67% of its US dollar value.

The market turmoil significantly affected sentiment across the digital asset ecosystem, which was reflected in our flows for the quarter. Our ETH portfolio saw the highest outflows, dropping from 70,445 ETH on 1 April 2022 to 33,670 ETH as of 30 June 2022.

We also saw some outflows from our stablecoin portfolios, down from $186,196,982 on 1 April 2022 to $136,278,651, marking a 27% outflow during the quarter. Stablecoins currently represent our largest asset type by US dollar market value.

However, we are pleased to report that our Bitcoin portfolio experienced a net inflow during Q2, up from 2,375 BTC at the start of the quarter to 2,411 BTC as of 30 June 2022, marking a modest increase of 1.5% in base asset terms.

We continued to grow our customer numbers during the quarter. With the help of our Referral Program, we attracted 5,554 new sign-ups in Q2, now sitting at a total of 85,110 Yield App customers.

Our Diamond Tier customer base increased in the same period, with 2,941 customers now in our highest tier – up from 2,825 at the end of Q1 2022.

Likewise, the amount of YLD locked up on our platform has also grown. The total amount of YLD locked on-platform now stands at 89,724,235 YLD.

The second quarter saw us pay out a total of $6,960,456 in rewards to our customers across all assets.

YLD Tier Bonus Rewards pool

On 14 July 2022, the YLD Bonus Rewards Pool for bonuses on base assets came to an end. From this point on, our customers will receive rewards on base assets (ETH, BTC, stablecoins) in the base asset only. This change does not affect the YLD on YLD staking and locking rewards.

The conclusion of the YLD Bonus Rewards Pool on base assets will result in a significantly lower inflation rate of our YLD token, as it transitions from a utility token to a full membership token, according to our long-term plans. We believe this development will be highly positive for our loyal customers.

Do you want to earn a secure and sustainable yield on your digital assets? Sign up for a Yield App account today!

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.