Arbitrage is a trading strategy that exploits inefficiencies in the market by taking advantage of mispricing between identical assets.

In the cryptocurrency markets, high volatility, an extraordinary level of innovation and a "move, fast and break things” development approach provides exceptional crypto arbitrage opportunities.

Arbitrage trading can serve as a hedging strategy as it provides relatively stable returns, regardless of the price performance of the underlying assets.

We look at the most common arbitrage strategies and consider their role as an investment strategy

In the first half of 2022, volatile financial markets were on everyone's mind. Sharp liquidation cascades and strong macroeconomic headwinds created extremely fearful sentiment as over-leveraged market participants filed for bankruptcy in the midst of a turbulent start to the year.

It is in these market conditions that market-neutral strategies, particularly crypto arbitrage strategies, can truly shine. As an integral part of our diversified investment approach, crypto arbitrage enables Yield App to provide strong risk-adjusted returns to our customers while remaining highly liquid at all times.

READ: How does Yield App conduct its due diligence?

Let’s take a deep dive into the depths of crypto arbitrage trading, looking at what exactly these market-neutral strategies involve and how they can play a vital role as an investment hedge.

What is arbitrage?

Arbitrage is a trading strategy that exploits inefficiencies in the market by taking advantage of mispricing between identical assets.

Arbitrageurs do this by searching multiple exchanges and even asset classes to make profits from the price differences.

Since the price differences are usually small, trading large volumes multiplies the returns into substantial sums. Therefore, arbitrage strategies are usually used by experienced traders such as hedge funds and other experienced investors.

It is due to arbitrageurs that prices in different markets tend to align.

Important indicators for arbitrage trading

As arbitrage trading is a market-neutral strategy, it depends on other indicators than directional trading data such as price movement.

Among those are price slippage, bid-ask spreads, market depth and liquidity. These provide insights into market structures that are not observable from price data.

Price slippage

Slippage occurs between the time of initiation and execution of a market order and describes the difference between the targeted execution price and the realized execution price. It usually increases in times of higher market volatility and can work in both directions, i.e. lead to a more or less favorable execution price for arbitrage traders.

Market depth

The market depth of an order book reflects the quantity and size of bids and asks on an order book at different price levels and describes the market’s ability to absorb huge market orders without letting the market value of an asset deviate too far from its fair value.

READ: How to spot if a crypto yield opportunity is “too good to be true”?

Bid-ask spreads

The bid-ask spread, often simply called the spread, is the price difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept for an asset.

Traditional market makers such as exchanges exploit this price difference by buying the asset at the seller's ask price and selling it at the buyer's bid price, making a profit on the spread, which represents the transaction costs for both the buyer and the seller.

While bid and ask prices indicate the supply and demand of an asset, the bid-ask spread can tell a lot about the overall liquidity of a particular market. Wider spreads also lead to increased volatility.

Market liquidity

The ability to convert one asset into another at its market price is referred to as liquidity. It refers to the extent to which a market, such as a stock market or crypto exchange, allows assets to trade with a tight bid-ask spread.

ETH/UDST trading

Should a market experience high selling pressure, for example, liquidity may dry up as buyers willing to accept prices at fair value fail to materialize and as a result, the spread widens. Consequently, crypto investors would have to forgo unrealized gains for immediate execution.

The relationship between spread, liquidity and market depth

The inherent relationship between spread, liquidity and market depth arises from the relationship between market makers (exchanges) and traders.

READ: The Merge – What to expect from Ethereum’s long-awaited upgrade?

When a market maker faces shallow market depth, large orders can easily lead to volatile price movements, increasing the risks for market makers, which in turn increases the bid-ask spread.

In contrast, a strong market depth (a large amount of orders in the order book) indicates a liquid market, as the order book can accommodate larger market orders without causing dislocations in the market. Under those conditions, spreads tend to narrow.

Consequently, a smaller spread usually indicates a liquid market. These indicators form the basis for successful arbitrage execution. Below follows a list of the most important arbitrage strategies that utilize these indicators.

Arbitrage strategies

Cross exchange arbitrage

Cross exchange arbitrage (sometimes called venue or geographic arbitrage) is a very simple form of arbitrage trading. It involves arbitrage traders buying and selling a digital asset simultaneously on two exchanges in order to profit from market inefficiencies and price differences.

Liquidation arbitrage

This strategy involves the liquidation of multiple highly leveraged and large positions on a derivatives exchange during volatile market conditions.

Futures in highly leveraged markets, such as the crypto market, often trade in contango (above the clearing price of the cash market). However, they are vulnerable to rapid price declines in liquidation events, such as we experienced in the first half of the year. During such events, futures typically trade in backwardation for a short period of time.

Since prices usually return to contango quickly, speed is key to this mean-reversion strategy. Within a few minutes, the liquidated long derivative contracts are bought only to be sold on the spot market immediately afterward.

Triangular arbitrage trading

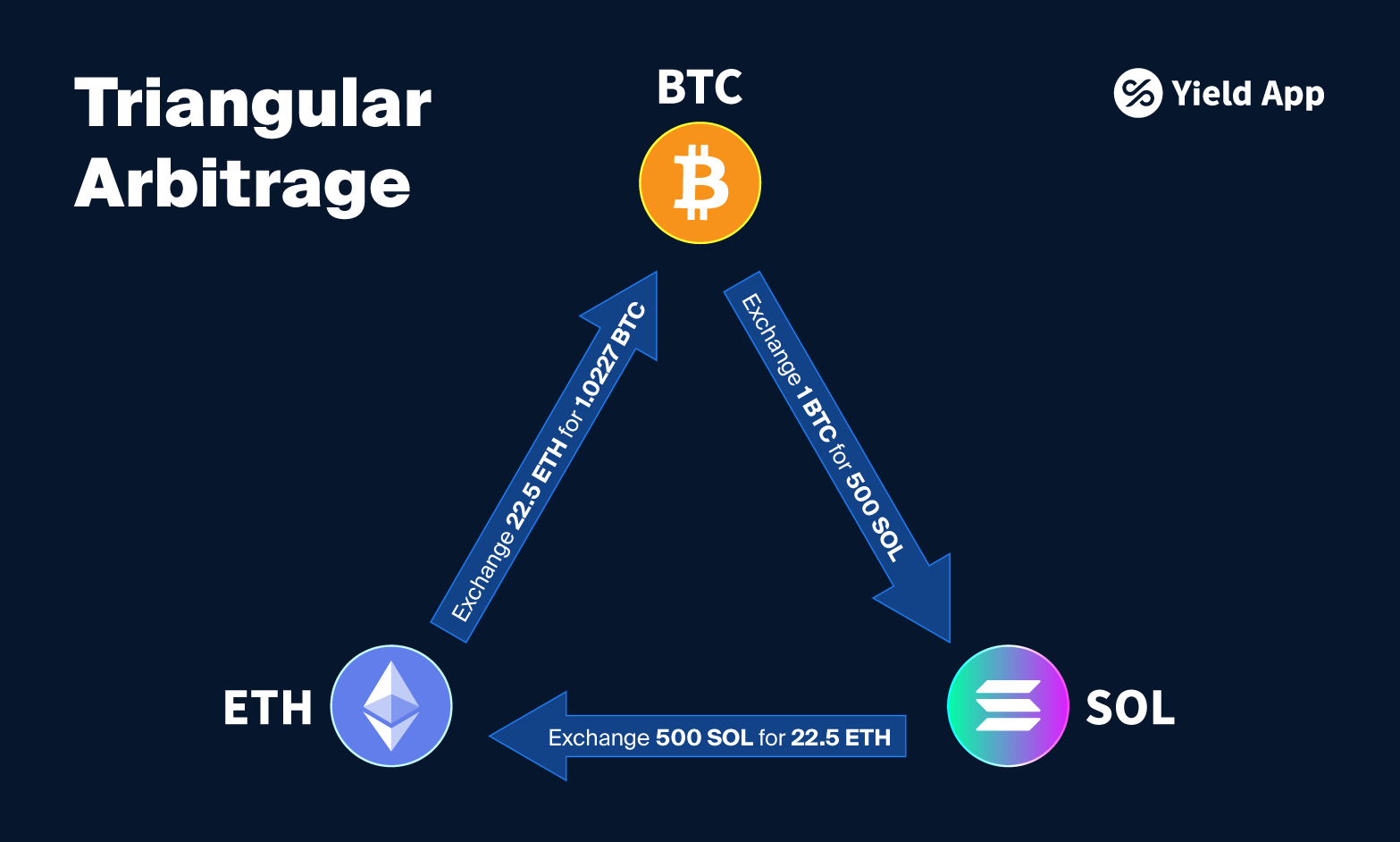

This is a process that exploits price discrepancies within three asset pairs, such as cryptocurrency pairs, on one or more exchanges. The trader typically shifts funds in a cycle from asset A to B, B to C, and C to A, increasing their allocation of asset A. This can be done on one exchange or, if the assets are also locally undervalued, on multiple exchanges.

Crypto arbitrage trading example

As cryptocurrency arbitrage trading might look like a complex venture at first glance, let’s take a look at a simple example of a triangular arbitrage trade on a single exchange.

We will calculate based on assumed fair values and market values. The fair value refers to the broad measure of what an asset is worth, while the market value refers to how much an asset is worth on the local market (exchange).

Triangular arbitrage trading example

At fair value, a trader would receive 488.89 SOL for 1 BTC (22000/45). However, the SOL/BTC trading pair provides an arbitrage opportunity because SOL is trading below market value. At this moment, a crypto arbitrage trader can exchange 1 BTC for 500 SOL (1/0.002).

However, in order to make a profit and return the value to the original asset, the trader exchanges 500 SOL into 22.5 ETH via a second trading pair and then into 1.0227 BTC. As a result, the trader can make a profit of 2.27% on his original asset.

How triangular arbitrage works

Note that three trades were required to execute this crypto arbitrage trade, each of which reduced the potential profit due to fees, which we have not considered in this calculation. In the case of cross-exchange trading, these fees could increase further due to the deposit and withdrawal fees of the respective exchanges.

Arbitrage opportunities in the crypto market

One can see why the digital asset market offers particular arbitrage opportunities when compared to traditional financial markets.

In 1987, the US stock market experienced its largest single-day price drop, fueled by a mix of panic selling, margin calls and automated trading, which was relatively new at the time and had never been tested in such volatile conditions.

The widespread use of stop losses exacerbated the sell-off, and the subsequent 20% plunge shocked investors and policymakers alike. In response, safeguards such as trading halts and so-called Rule 80B, which mandates exchanges to impose trading halts on securities when certain thresholds are exceeded, were introduced to prevent a recurrence of such events.

In the digital asset market, for comparison, a 20% sell-off is nothing unusual and happens multiple times a year as most parts of the ecosystem remain unregulated while the extraordinary level of innovation and a "move, fast and break things” development approach provides extraordinary crypto arbitrage opportunities.

READ: How to find opportunities in a bear market

Extreme volatility, high momentum and the lack of composability within crypto trading often lead to temporary dislocations. The average volatility (80% to 100%) remains consistently high compared to stocks and gold, even during market crises.

Crypto bid-ask spreads

As trade volume continues to grow, this trend is not expected to reverse any time soon, while momentum and temporary draw-downs continue to increase the alpha of cryptocurrency arbitrage opportunities.

How do you identify a cryptocurrency arbitrage opportunity?

In the cryptocurrency market, the highly fragmented market structure with multiple centralized or decentralized cryptocurrency exchanges, many of which struggle with broken liquidity, provides a large number of arbitrage opportunities. The sentiment-driven environment also invites exploitation of emerging market structures.

To detect market inefficiencies, traders need to compare identical currency pairs and/or different asset classes on different exchanges and analyze data such as price divergence, market depth, bid-ask spreads and market liquidity. This data can be accessed with the help of a digital asset data provider such as Kaiko.

Arbitrage trading risks

Execution risk

This is the risk of price slippage between the execution of two arbitrage trades. Should an arbitrage opportunity arise in the form of price differences between spot and futures prices, crypto arbitrage traders would have to go to the futures area of the exchange to sell the futures and then go to the spot market to buy the spot position.

By the time the trader wants to buy the spot position, the price may have already rallied, and as a result, the returns could either diminish or, worse, turn into a loss. Arbitrage trading is all about execution.

Should crypto arbitrage traders move funds between exchanges or blockchains, timing becomes even more critical, as a centralized exchange may conduct time-consuming anti-money laundering (AML) compliance checks, while some blockchains still have slow transaction speeds.

Execution costs

Arbitrage trading, like all forms of buying and selling crypto assets, involves trading costs that can eat away at the potential profits. High trading volume can help avoid high fees. In this respect, institutional investors and traders have the upper hand over small traders.

However, these costs can multiply in cross-exchange arbitrage, which incurs additional withdrawal and deposit fees. Alternatively, the arbitrage trader could deploy assets on multiple exchanges to be ready for upcoming opportunities and to avoid these costs. This, however, requires vast amounts of capital.

Counterparty risk

Counterparty risk involves the failure of a counterparty, such as one exchange, to execute one part of the trade, leaving the arbitrage traders unable to execute the trade and potentially facing substantial losses.

Arbitrage strategies as an investment hedge

Arbitrage trading is a fundamental building block of market-neutral trading strategies.

While most high-return investments or trades depend heavily on price movements or counterparty risks, the success of arbitrage trading strategies depends on a number of completely different and uncorrelated factors, such as recognizing price discrepancies between centralized and decentralized exchanges and the ability to provide liquidity at critical, volatile times.

For crypto arbitrage trading, it is necessary to recognize sentiment swings in the market dominated by retail investors in order to detect opportunities that arise in the spot and derivatives markets.

READ: Five tips to secure your crypto account during holiday season

Therefore, arbitrage trading, when done successfully, is a great tool for generating relatively stable returns, regardless of the price performance of the underlying assets.

This advantage has been particularly evident in recent months, when the crypto market experienced a sell-off that mostly affected those who were invested in directional strategies or lent money to companies that have done so.

Key takeaways

While volatile market sell-offs can be a burden on the crypto ecosystem and cause extremely negative sentiment among investors, they also represent an opportunity to generate profit.

Crypto arbitrage strategies offer a valuable tool for those seeking market-neutral, low-risk returns. As such, they have a firm place in our diversified investment approach.

Over time, as more capital comes into the market and policymakers present a regulatory framework for crypto exchanges, the cryptocurrency market is likely to be less prone to highly volatile liquidation cascades and abundant price dislocations.

However, crypto arbitrage trading requires high volumes to exceed trading fees, a secure infrastructure and high trading expertise and should therefore only be undertaken by experienced traders. Those without the technical knowledge, tools, and liquidity can gain potential profit from arbitrage strategies through exposure to hedge funds or digital asset management platforms.

IMPORTANT NOTICE: This blog does not constitute investment advice and is for informational purposes only. The price of digital assets can go down as well as up and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.

Do you want to earn a secure and sustainable yield on your digital assets? Sign up for a Yield App account today!

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.