Marking a full first year of reporting, Yield App is pleased to publish its Q4 2021 report showing 71,356 customers joined our platform during 2021, up from 60,000 at the end of Q3 and representing quarter-on-quarter growth of 19%.

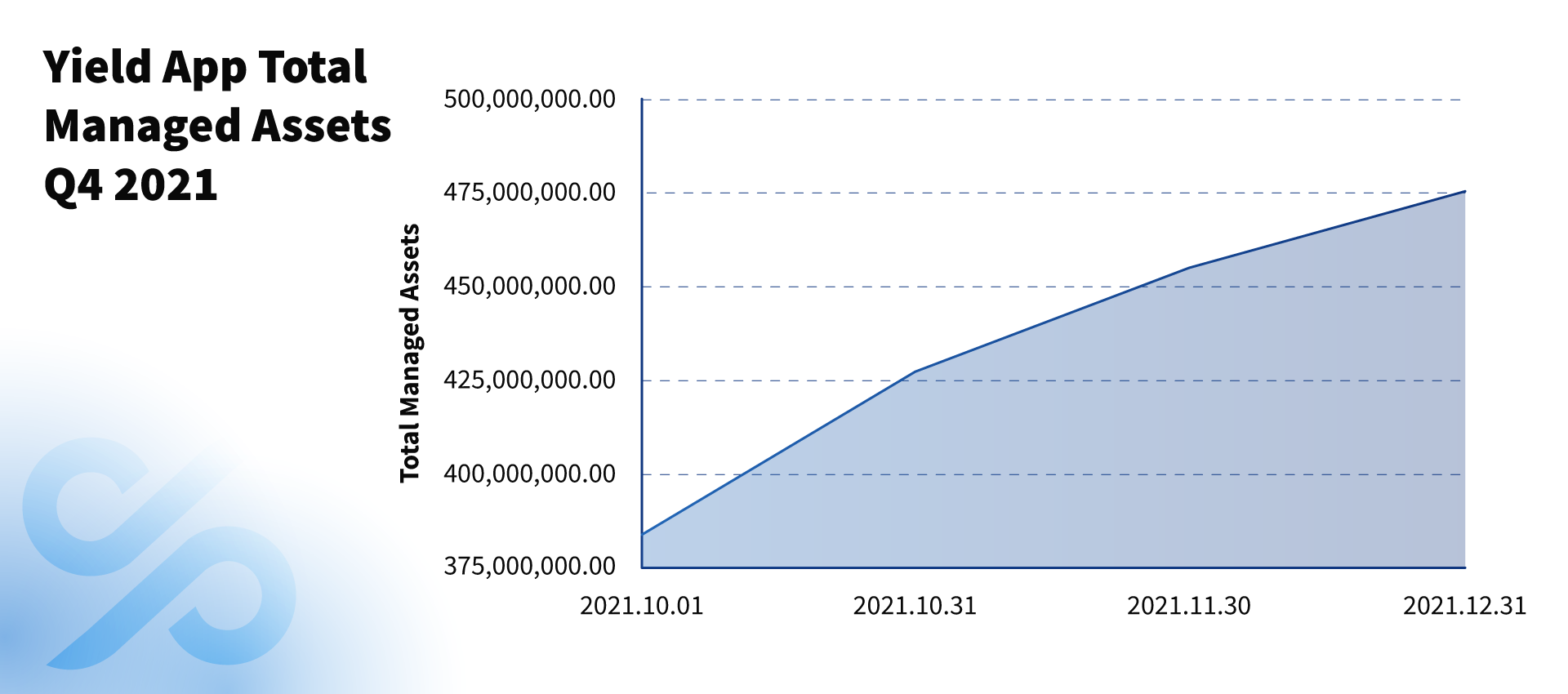

These customers deposited over $475 million of assets up to 31 December 2021 – a 40% increase from $339.4 million at the end of September. This continues the strong and steady growth Yield App has seen since its launch in February of last year, and which we expect to continue into 2022.

Some of our strongest inflows came into our Bitcoin Portfolio, which saw its assets increase by close to 50% from 988 BTC at the end of September to 1,456 by December 31, 2021, representing a market value of $70,067,612*.

As in the previous quarter, the re-opening of the portfolio in October marked our strongest period for new customer sign-ups, with 1,439 customers joining us in the five days the portfolio was open to deposits and withdrawals (10 to 15 October).

Ether (ETH) remains our largest asset by market value, with 62,607 ETH now managed on-platform, valued at $238.35 million as of 31 December 2021. In addition, over $42.4 million of USDC and $3.1 million of USDT was added to our stablecoin strategies, with total assets across USDC and USDT standing at $141.7 million by the end of 2021.

Our Diamond Tier (formerly Tier 5) of members that hold at least 20,000 YLD in their on-platform wallets also grew to 2,338 by the end of the year, an increase of 19% compared to Q3. Our Diamond Tier members remain a key group for Yield App, playing a vital role in the stability of the entire ecosystem.

Rewards

The Yield App APY structure and Tier Membership Rewards program means that customers are rewarded in part with our YLD token, with those that hold more YLD tokens in their wallet earning higher overall APYs. In Q4, we are pleased to report that over 19.3 million YLD tokens were earned by our customers. This brings the total YLD rewards paid to our customers since inception to 41.2 million, with a market value of $11.5 million.

In addition, we are thrilled to report that over the whole of 2021, we paid more than $29 million to our valued customers in USDC, USDT, ETH, BTC, and YLD rewards combined.

Product development

The fourth quarter of the year was perhaps the busiest period for Yield App’s developers since our launch as they worked tirelessly to deliver our hotly anticipated V2 upgrade. Launched on January 18, 2022, we will publish a full review of the rollout in our Q1 2022 report. Suffice to say, however, that V2 delivered the features and functionality our community has been requesting and expecting. These include:

Stake and lock YLD

With V2, customers can stake or lock YLD tokens to earn additional rewards.

Full cycle conversions

Customers that have completed Know Your Customer (KYC) level 2 can now convert any of their existing assets for another asset available within the platform, subject to a daily limit of $5,000 (USD value).

New digital assets

By popular demand, the first new asset to join our stable in V2 is algorithmic stablecoin DAI, with more to follow in the coming weeks and months.

Enhanced security features

V2’s enhanced security features include the ability to set a limit on daily withdrawals, an automatic logout feature, and a customer activity log.

Control over compounding and earnings

Customers can now choose to auto-compound their earnings, auto-deploy deposits from their wallet into a portfolio, and earn an extra 2% p.a. by choosing to earn all their rewards in YLD.

Rewards performance 24h/7d/30d

Earnings in the brand new and improved dashboard can now be viewed over the past 24 hours, 7 days and 30 days, and in a selection of currencies.

For a full FAQ on V2 and all of its new features and functionalities please see the below blog post.

READ: Everything you need to know about the Yield App V2 launch

YLD

Our treasury rebalancing program continued throughout Q4, with 6.4 million YLD tokens rebalanced over the period. This contributed to an overall total of 35.2 million tokens rebalanced since our inception, as we continue to support the Yield App ecosystem and ensure that it continues to thrive. Customers can monitor our rebalancing program via the following wallet address: https://etherscan.io/token/0xf94b5c5651c888d928439ab6514b93944eee6f48?a=0x1a11848434cafa84a676e70459015407ec15b542

The rollout of Version 2 of our platform in January 2022 has seen us move to a new Tier Membership Rewards program that provides further incentives for our customers to participate in the Yield App rewards system. This includes scaled base rates for all of our assets depending on Tier, the opportunity to earn rewards all in YLD and lock YLD for 12 months in return for an APY of 12%.

After months of extensive consultation with our community, we believe this new system better meets the needs of our customers, while also being better in line with our own business objectives. As quarterly emissions of YLD reduce by an estimated 60% to 75%, we also expect this to improve sustainability for our utility token and its long-term holders.

Relationship manager program

Marking a key point of difference in our offering to our highest Tier members, we have appointed Relationship Managers (RMs) on different continents to further enhance the personalized service we provide to these customers.

Around 1,000 Yield App clients have reached VIP status (requiring a balance valued at USD $100,000 equivalent or more), with around half of these now assigned a dedicated Relationship Manager tasked with further developing these clients’ relationship with Yield App.

In response to the positive feedback we have received to this program, we are in the process of further building out our global team of RMs, with several hires taking place in Q4 and beyond. Some of the services offered by our RMs include:

Assisting in setting up corporate accounts and self-managed super fund accounts (Australia)

Meeting with client's extended networks to answer questions one-on-one and explore opportunities for them and their businesses

Ensuring quick and personalised responses to any support enquiries

Considering feedback and discussing future plans for Yield App's services

Enabling access and providing support for testing of new platform releases

Portfolio management

Overview

In-line with our Q3 portfolio management update, our total managed assets continued to grow in Q4, alongside the addition of new individual customers and institutional clients. With our focus on capital preservation through the use of market-neutral strategies, we are pleased to share our portfolio update.

Over the fourth quarter, the portfolio team allocated into and rotated positions across 17 approved DeFi market-neutral pools. We further increased our allocations via in-kind subscriptions to external investment managers bringing our total number of approved external investment managers to seven.

These external managers predominantly focus on market-neutral liquid alpha strategies (e.g. arbitrage and market-making). We also made a small allocation to two-directional, smart-beta-focused strategies with strong track records and best-in-class governance processes.

Our allocations comprised three different underlying base assets (BTC, ETH, and USDC). The overall risk spread of the portfolio continues to look to achieve market-neutral exposures and consistent risk-adjusted returns. Our APY generation has remained healthy, and our overall portfolio has continued to show healthy returns, allowing us to maintain market-leading rates across our base assets.

As the quarter came to a close, we were pleased with the overall performance of the portfolio as increased volatility and price action saw a marked pullback in base asset price levels. We will continue to adjust rates both up and down depending on market conditions to ensure that our annualized rates are sustainable, which remains our highest priority.

On the project development front, the DeFi team has laid the initial groundwork for establishing the frameworks to support the next stage of evolution within our in-house risk analysis tools. While the current modeling provides a comprehensive, robust analysis of the inherent risks surrounding capital deployment, we acknowledge that in such an innovative space, there is always room for improvement as more information becomes available week on week.

Our new toolset seeks to establish an industry standard, outlining best practice recommendations for budding protocols to not only add security to their platforms but garner community confidence by adhering to gold standard operational security procedures during development and protocol deployment.

Capital Allocation

We are currently allocated across a selection of well-distributed positions, with the large majority deployed across the Ethereum ecosystem.

During Q4, the continued expansion of a multi-blockchain world has driven capital to dilute over a variety of blockchain ecosystems. This can largely be attributed to early adoption incentive design and the increase in operational expenditure customers are experiencing as Ethereum network congestion challenges the economic viability of self-managed DeFi strategies. This is ultimately driving customers to adopt less congested chains in a trade-off for decentralization.

While the rising cost of gas fees does impact our operations at Yield App, we are able to absorb these costs into our operational expenses without passing that on to our customer base. We, therefore, are able to offer Ethereum network security by proxy of large-scale capital deployment.

Liquidity provision and systematic trading

Our external manager allocation is heavily geared towards two strategy types: liquidity provision and systematic trading.

Liquidity provision strategies create a relatively stable and uncorrelated return profile, as they are directionally agnostic and very liquid. These strategies capitalize on highly fragmented markets. Examples include market-making and arbitrage.

Our systematic trading strategies utilize market signals to inform their positions across multiple strategies. The strategies provide attractive alpha given the inefficiency and volatility across our base assets. These strategies are mostly short-timeframe (hours/days) and use limited or no leverage. Examples include statistical arbitrage and relative value (RV).

As market volatility increased through Q4, our managers continued to perform in line with our expectations and we are pleased with their risk management and performance over the quarter.

In order to provide further transparency and increase the governance across our portfolio, we have begun the process of building out a fully regulated asset management platform and hope to complete this by the end of Q1 2022. This platform will allow us to manage our assets more effectively as we increase the diversification across our portfolio, as well as give us greater access to be best-in-class external managers and strategies.

Due-diligence and diversification

Over the fourth quarter, we strengthened our due-diligence processes further and we are pleased to share that both Kroll (a Duff & Phelps company) and PerForm Due Diligence (a JTC company) have been engaged by us to provide risk, governance, and continuous monitoring services on our behalf.

Both of these organizations have extensive experience in providing these services and we are pleased that they have agreed to work with us as we expand our portfolio management capabilities.

External audit & proof of reserves

As previously stated in the Q3 report, we have engaged Armanino, one of the top 25 largest independent accounting and audit firms in the United States, and the global leader in digital asset audit solutions.

Armanino is engaged by many of the leading blockchain firms, including stablecoin issuers and wealth management platforms amongst its 7,000+ clients.

This engagement is for the purpose of offering Yield App’s customers, prospective customers, regulators, and business partners additional transparency and assurance over the assets held by us as reserves against outstanding customer liabilities.

We are pleased to share that this initial proof of reserves report was completed on January 24, 2022 using a ‘point in time’ methodology to determine the results, the full report published by Armanino can be read here.

We will continue to work with Armanino and other third-party accreditation service providers to release bi-annual independent reports across our group business activities as we grow.

Regulatory advocacy

Having joined the advisory Council of Global Digital Finance (GDF) in 2021, we continue to emphasise the importance of ‘having a voice’ as regulation of the digital asset ecosystem evolves rapidly.

Our CFO/COO, Justin Wright is co-chair of the GDF DeFi working group alongside his participation as a member of the KYC/AML working group. The latter group’s objective is to provide a holistic view of approaches to regulation of decentralized entities to ensure that regulatory touchpoints and policies are implemented in harmony with innovation across the ecosystem.

As a part of this endeavour, Justin has also contributed an article to the 2021 GDF annual report, ‘Digital Money and Nextgen Market Infrastructure’, published on the January 31, 2022. The report can be read here.

Market growth

In line with our 2021 H2 strategy, Q4 saw us continue our global growth efforts in key target markets. This saw our total managed assets in East Asian and South East Asian markets increase by 35% compared to Q3, to stand at $29.6 million as we added a number of new Diamond Tier members depositing more than $100,000.

As we rolled out a large marketing and PR campaign in the region over Q4, our customer base also grew by more than 60% across the entire Pan-Asian segment. Europe also continues to be a strong growth market for Yield App, with customer numbers up by 17% over Q4 compared to Q3.

Marketing and communications

Key campaigns

West Ham competitions

In Q3, Yield App became the Official Digital Asset Wealth Management Partner of top Premier League football club West Ham United, based in London in the UK. Following this heavy-weight partnership, Q4 saw us run a number of key marketing campaigns to promote this successful move.

Immediately following the announcement, Yield App ran a social media competition, giving away a signed West Ham football shirt and football to two lucky winners. We also marked the first week after the announcement with a West Ham-inspired Yield App Community Game. Overall, the West Ham campaign generated 420,000 impressions and 12,000 engagements.

Halloween NFT event

During the week leading up to Halloween (Sunday, October 31, 2021), we ran an engaging

scavenger hunt campaign. We asked our customers to find Yield App logos in animations, as well as to spot hashtags and hidden pumpkins on our website. The campaign ran for four days leading up to Halloween, with the Grand Prize – a special Yield App NFT – awarded to one lucky winner on October 31. The campaign generated 240,000 impressions and 8,500 engagements.

Christmas advent calendar

During the month of December, we ran a festive advent calendar campaign, inviting our customers to participate in daily giveaways for the 24 days leading up to Christmas Eve. We gave away a range of exciting prizes, from gift cards and Yield App merchandise to NFTs and YLD rewards. The grand prize was a totally unique, one-of-a-kind Yield App “ugly Christmas sweater” NFT. Overall, this campaign generated 720,000 impressions and 38,000 engagements, with over 5,800 participants.

Community and social media

Growth across our community and social channels continued apace in the fourth quarter, with the total number of Yielders across all global and regional channels now standing at more than 102,300. This is up from 96,600 followers at the end of Q3, and 87,000 at the end of Q2, showing strong and sustained growth and engagement in our channels.

Global impressions and engagements

Our engaging social media campaigns and strong presence across all key channels helped our global impressions and engagements continue to grow rapidly in Q4.

Across Twitter, Facebook, Instagram and LinkedIn we saw impressions grow 25.7% to 4.8 million between October and December 2021, while engagements grew 73.4% to a total of 165,139. By focusing our attention on visually engaging content, we once again saw the greatest growth in our Instagram numbers, with impressions and engagements up 36% and 118% respectively in the fourth quarter compared to Q3.

Media and events

Yield App remained active in the media and events space through Q4. Our new chief investment officer Lucas Kiely featured in a feature-length documentary. Co-produced by ITN Productions and FinTech Circle, “Responsible Fintech” explores the latest innovations, insights, solutions, and future trends for the fintech sector.

The film premiered live at the Fintech Connect Conference in London on 1 December, and will further feature at the Fintech Innovations for Small Businesses event launching on January 20, 2022. The latter conference is in partnership with the Federation of Small Businesses (FSB), and will be made available to the FSB’s 150,000+ members.

In November, our CEO Tim Frost spoke on an expert panel alongside Swissborg and Bumper at DeFi Live, another London-based event for which we were proud to be a headline sponsor. In Africa, we were thrilled to work with the African Blockchain University to sponsor two educational workshops on NFTs and DeFi for local artists as part of our work to ensure everyone has access to leading digital wealth creation opportunities.

Our PR and marketing efforts also ensured we maintained a strong media presence throughout Q4, as Yield App featured in more than 1,200 articles across the global digital press, reaching a combined 1.3 billion readers in every corner of the world and totaling an Advertising Value Equivalent (AVE) of $12.7 million. Tim remained a key resource for the financial media, lending his insight to global Tier 1 outlets including Business Insider, Business Insider India, FR24 News, and Yahoo Finance.

In-house, we remained active on our YouTube channel with our live Ask Me Anything (AMA) sessions featuring Tim, our CMO Adrien Geneste, and our COO/CFO Justin Wright, with our Tier Rewards and V2 update video garnering over 2,000 views. We also continued our panel show, Fridays with Yield App, where our head of communications Rebecca Jones interviewed industry experts on topics including protecting the digital asset sector and what the burgeoning metaverse could mean for cryptocurrency.

Corporate business development

Corporate clients

Growth in the corporate and institutional clients segment accelerated between October and December to around 100 clients. Corporate treasury management for blockchain startups that raised funds, institutional digital asset funds that diversify their investments into our fixed rate offering, as well as more traditional family offices, found a strong partner in Yield App. Our corporate and institutional client base comes from across Europe, Asia, and Australia.

Corporate and institutional funds now comprise over 5% of our total asset base, with almost half of these funds in ETH, and over 20% in BTC. Stablecoins account for 35%, as they remain the preferred assets of our corporate treasury management clients, including more traditional fiat-native clients. For this group, we facilitate conversion from fiat currencies into digital assets by way of over-the-counter (OTC) trades with regulated financial institutions.

With our V2 platform launch, Yield App will start actively approaching the corporate and institutional segment with a targeted campaign. We aim to better inform this market of the attractive risk-return opportunity Yield App can offer in terms of diversifying a financial portfolio, or as a corporate treasury tool.

For many, diversifying a portion of treasury assets to a liquid portfolio paying 18% interest on stable assets is a welcome addition to a wider treasury strategy. Be it corporate, institutional or individual clients, Yield App is fully equipped to manage these assets.

Key hires

Peter Hulks, Senior Relationship Manager

Peter is an entrepreneur and events specialist with experience in a variety of arenas, from The Olympic Games to Formula 1 and music festivals all around the globe. Peter has worked with some big names in the sports and entertainment world, but in February 2021 he discovered Yield App and everything changed.

As Senior Relationship Manager, Peter works closely with our top clients to help make the transition from traditional to digital finance as seamless as possible.

Elliott Hoffman, Head of Business Development

A blockchain business development and US Navy veteran, Elliott started his digital asset journey doing arbitrage between DeFi and CeFi instruments, before becoming the VP of Business Development / Managing Director of the Hong Kong office for one of the world's largest P2P crypto exchanges.

His primary focus at Yield App is on discovering and expanding upon business development verticals that can turn into partnerships, increasing assets, and ultimately growing the business. We are also fortunate to have Elliott as a regular representative for Yield App at industry conferences. Elliott has a strong passion for everything related to business development and is happy to answer any question, any time.

Gero Piskov, Cards & Payments Manager

Gero is an experienced payments manager who joined us from Crypto.com. Gero saw the potential of the crypto industry and joined it in 2019. Since then, he has acquired several professional certifications on blockchain, digital assets and cryptocurrencies from The University of Nicosia School of Business, the first university in the world to offer blockchain education.

Gero is instrumental in developing Yield App’s payment infrastructure. Some of his current responsibilities include: engaging with global partners, leading the communication and negotiation processes, as well as ensuring that their offerings satiate our envisioned programs from a financial, technical, functional and regulatory standpoint.

Diana Gonima, Investor Relations Associate

Diana is an attorney with an emphasis on corporate law. She holds a Master's degree in international business law from the Esade Law & Business School in Barcelona and is passionate about security in the digital asset sphere. At Yield App, Diana is part of the investment team and will assist in conducting due diligence on our investment managers.

Von Henriex, Motion Graphic Designer

A former multimedia producer at a P2P crypto marketplace company, Von has a wide range of experience in the multimedia industry and has been doing animation for almost six years. He started crypto trading in 2020.

At Yield App, Von works alongside the content, socials and design teams to provide animation and digital footage. As the only video creator and animator in his team, he aims to improve the quality and quantity of digital footage produced to reach more people and spread the company's mission.

Anna Fedorova, Content Manager

A financial journalist with over a decade of experience, Anna cut her teeth as news editor at a London-based financial title, before leaving the UK to embrace the digital nomad dream as a freelance journalist. She began working for Yield App as a freelancer, but couldn’t resist the lure of a full-time role in the fast-growing crypto space with such an exciting business.

At Yield App, Anna is responsible for all English-language content planning and creation, working closely with teams across the company to create content for social media, email communications, blogs, and the weekly newsletter.

Giorgio Filippi, Community Manager, Italy

Giorgio joined Yield App as a full-time employee in September, but has supported us from our earliest days. Following a year spent studying in California, Giorgio has a strong interest in economics and, of course, cryptocurrency.

In his role at Yield App, Giorgio stays in close contact with our valued community members via our Telegram and Discord channels, responding to feedback and helping us continuously improve our service. No matter how small the question, Giorgio can be contacted via direct message or on the Telegram group @giorgiofil2000.

Dear Yield App supporters,

February marks one year since we launched Yield App to the world, and I couldn’t be more proud of where we are today. While this is of course the Q4 report, I am writing this commentary in January 2022 following a highly successful launch of Version 2 (V2) of our platform. More details of this will follow in the Q1 2022 report, but the launch has been as successful as we all anticipated.

The feedback we have received so far has been immensely encouraging: we really listened to what our customers wanted as we built this product, and we are thrilled with the results and looking forward to building on it in the coming year. As we have mentioned in previous commentary, V2 is the launchpad from which we can really begin to grow Yield App products and offerings in a truly meaningful way.

This first half of 2022 will also see the launch of our android and iOS mobile apps: something I know our community has been looking forward to for some time. As ever, though, it was very important to us to ensure that everything came at the right time, and now with the successful rollout of the V2 web app, it’s time to deliver this vital piece of the puzzle.

In addition, we will be implementing advanced fiat rails during the first half of 2022. As our customers will know, we introduced On-Ramper last year, however we have been busy in the background building our own capabilities in order to lower fees for our customers while ensuring they are still easily able to convert their fiat to digital assets. We also look forward to expanding our in-app conversion capabilities over the first quarter of the year. This will include raising daily limits significantly once we have expanded our technical capabilities.

As the Ethereum blockchain has grown in popularity, but not necessarily in scale, we are aware that our customers are also excited to see some other blockchain capability at Yield App. As such, we plan to implement Binance Smart Chain in the first half of the year, with more to follow soon after.

Of course in the world of digital assets, markets go up and markets go down, and as I write we find ourselves in somewhat of a down market. Fortunately, however, Yield App is perfectly positioned to take advantage of these conditions. We provide reliable, stable passive income to our customers regardless of market movements, allowing them to build essential portfolio buffers.

Yield App experienced incredible growth in our first year, with close to $500 million of assets now managed on platform for 70,000 customers to date. However, we believe that 2022 will be an even bigger, better and more exciting year for our customers and community members. We thank you all, as ever, for your support and look forward to continuing to serve you over the coming months and years.

Yours sincerely,

Tim Frost

CEO of Yield App

Do you want to earn the market’s leading APY’s on your digital assets? Sign up for a Yield App account today!

*All asset values are quoted as of 31 December 2021 and sourced from CoinGecko.com

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.