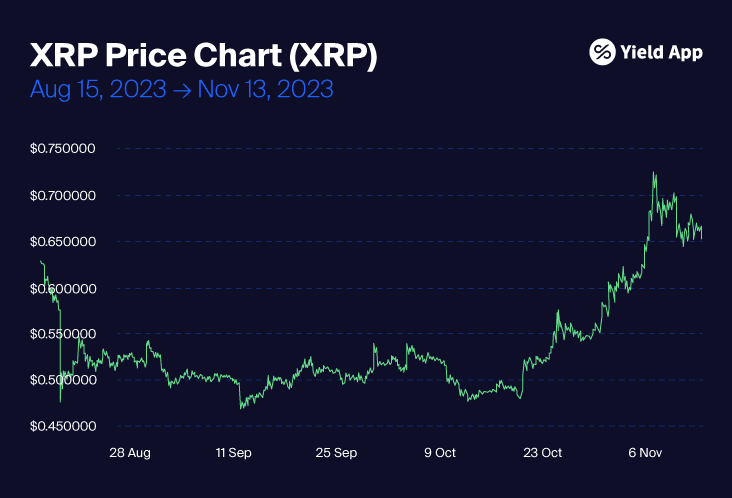

XRP – the native token of Ripple Labs – has been in the news a great deal lately, after Ripple won its long-standing battle with the US Securities and Exchange Commission (SEC) back in July. Over the past year to 13 November 2023, XRP is up around 80%, currently trading at around $0.66. However, it hasn’t been a smooth ride for the token that was once (briefly) the second-largest cryptocurrency by market capitalization.

READ: Wait, how can Yield App pay up to 11 % APY?

While July’s news sent the token to a 2023 high of $0.82, it quickly retreated to trade around the $0.50 mark by mid-August. It was not until October 2023 that XRP broke out of this lower range again, rising some 36.7% over 30 days to 13 November. So what’s been driving XRP’s ups and downs and what’s in store for this sleeping giant?

Back to basics: The early days of XRP

First created by OpenCoin in 2012, which later became Ripple, XRP’s goal was to facilitate fast and cost-effective cross-border transactions. Its aim was to address the inefficiencies and delays in the traditional banking system, challenging the existing sluggish and expensive SWIFT network.

The next five years saw XRP gain strong traction as financial institutions and payment service providers adopted it as a means of international settlement. Notable partnerships included American Express and Santander. During the 2017 bull rally, XRP saw its price skyrocket. On 7 January 2018, XRP hit an all-time high of $3.40, briefly becoming the second-largest digital asset by market cap after Bitcoin.

READ: Solana’s renaissance: How sustainable is the SOL rally?

However, it soon faced regulatory challenges. In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that the project had illegally sold some $1.3 billion of XRP as an “unregistered security”.

This lawsuit weighed heavily on Ripple. In the weeks following the allegations, nearly all US exchanges delisted the XRP token, which dropped from $0.66 to around $0.21 during the month of December 2020 alone.

With this black cloud hanging over it, XRP’s price never reached its all-time high during the 2021 bull run. It hit a peak of $1.57, before plummeting again alongside other altcoins amid the 2022 crypto market crash.

XRP’s legal woes and victories

However, 2023 has proven successful for Ripple so far. July marked the first big legal win, as Judge Analisa Torres in the Southern District of New York ruled that so-called “programmatic sales” – those conducted without direct contact with the buyer – do not violate federal securities law. This sent the XRP token soaring 75%.

READ: So, you think you know SOL?

October saw two more victories for Ripple. Firstly, Judge Torres denied the SEC’s motion to file a so-called “interlocutory appeal”. Then, the SEC voluntarily dismissed its own case against Ripple Labs’ CEO Brad Garlinghouse and its Executive Chairman Christian Larsen.

Yet the battle isn’t over yet. The SEC is likely to appeal the “programmatic sales” ruling and this prospect is keeping a lid on XRP’s price. On top of this, the ruling only affected XRP sales conducted via crypto exchanges. Sales to institutional investors are still likely to draw a penalty.

Life after the SEC

In short, there are still causes for concern when it comes to XRP. However, reports suggest that the lawsuit has now entered a settlement phase. A settlement would bring closure and much-needed clarity to this ongoing legal dispute. However, crypto investors may also see this as an opportunity for the regulator to kick the can down the road on crypto regulation.

The SEC has 90 days from 9 November to conduct “remedies-related discovery”, which means a final resolution may not come until February 2024.

Find out how much you could earn on XRP with Yield App!

Meanwhile, according to an insightful Cointelegraph article, another positive that could come out of the SEC saga could be a move towards a more decentralized structure. According to the piece, Ripple’s centralized nature was “one of the main compromises” the project made in its bid to challenge the existing SWIFT payments system, one which forced it to “make adjustments and sacrifices”. The article suggests that Ripple now has an opportunity to “fix its closed system”.

Structural drivers of Ripple’s success

Beyond the SEC saga, institutions are once again beginning to recognize the inherent value of XRP. Earlier this month, Ripple announced a collaboration with the National Bank of Georgia on its central bank digital currency (CBDC) program.

During the same week, XRP gained a vote of confidence in Dubai, which approved the token under its virtual asset regime. This followed news in October that Ripple had secured a Major Payments Institution (MPI) license from the Monetary Authority of Singapore (MAS) as it eyes expansion in the Asia-Pacific region.

READ The State of Crypto Report: October 2023 edition

These headlines triggered a mini-rally in XRP’s price, along with a spike in trading volume which briefly took XRP’s market above BNB’s, making it the fourth-largest crypto asset. As of the time of writing, however, XRP’s market cap sits at $35.1bn, slightly below BNB’s $37.6bn.

Key takeaway

Like many altcoins, XRP has been on a a rollercoaster ride over the past few years. The SEC lawsuit placed enormous pressure on a cryptocurrency once aiming to replace the world’s biggest international settlement ecosystem. A prolonged bear market didn’t help matters.

However, Ripple has enjoyed a revival so far in 2023, with three victories against the SEC and a swathe of institutional partnerships and wins propelling XRP’s price higher. Yet concerns remain and XRP must still prove its resilience as we head into the bull market.

With the SEC saga behind it, could this sleeping giant reclaim its spot as one of the leading digital assets? Only time will tell. However, those holding XRP or investing for the first time can make this token work harder for them with Yield App, earning up to 3% p.a. on their holdings!

Want to make the most of your crypto? Open a Yield App account today!

Learn more

Learn more