The crypto community is anticipating next year’s upcoming Bitcoin halving as eagerly as football fans await the world championships. Similarly taking place every four years and slated for May 2024, many analysts are touting next year’s halving as one of the key catalysts for a bitcoin price rally. Some market participants are predicting BTC will finally rise above the $100,000 mark.

Sometimes whimsically referred to as the “halvening” in the crypto community, the event, which has already occurred three times since Bitcoin’s inception, has historically preceded steep rises in the price of the world’s biggest crypto asset. With the 2024 “halvening” just a few months away, could Bitcoin experience similar runaway success?

Understanding the Bitcoin halving

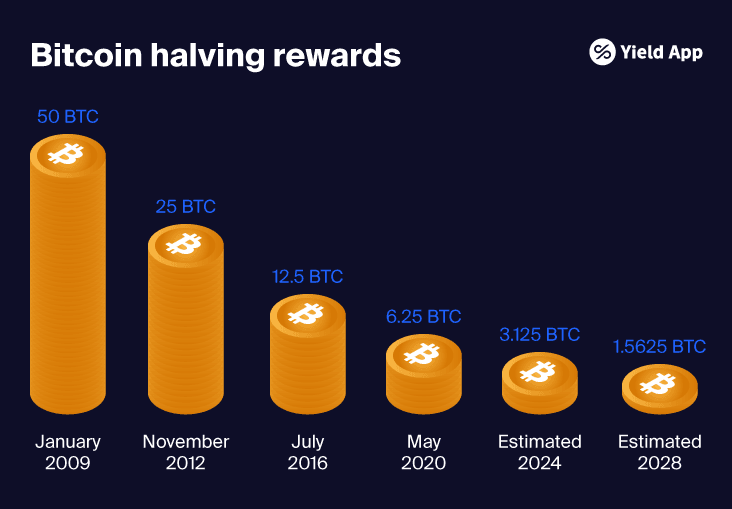

The Bitcoin halving is an event pre-coded into the Bitcoin blockchain which aims to maintain its scarcity and control the issuance of new blocks. It occurs around every four years, with previous halvings taking place in 2012, 2016, and 2020.

Every Bitcoin halving reduces the rewards miners receive for validating transactions on the blockchain in half (hence the name). As per the code, the “halvening” happens every 210,000 blocks mined. This usually occurs every four years but the exact date varies depending on network activity.

When Bitcoin was first created in 2009, miners who validated transactions gained 50 BTC for their work. This sounds like so much now, but at the time the aggregate value was still relatively low.

The first halving in November 2012 reduced these rewards to 25 BTC. However, by this point, bitcoin’s price had risen above $10 – to $13.45 on 31 December 2012, to be precise. As such, the rewards for mining one block were now more than $300. Mining bitcoins had become profitable.

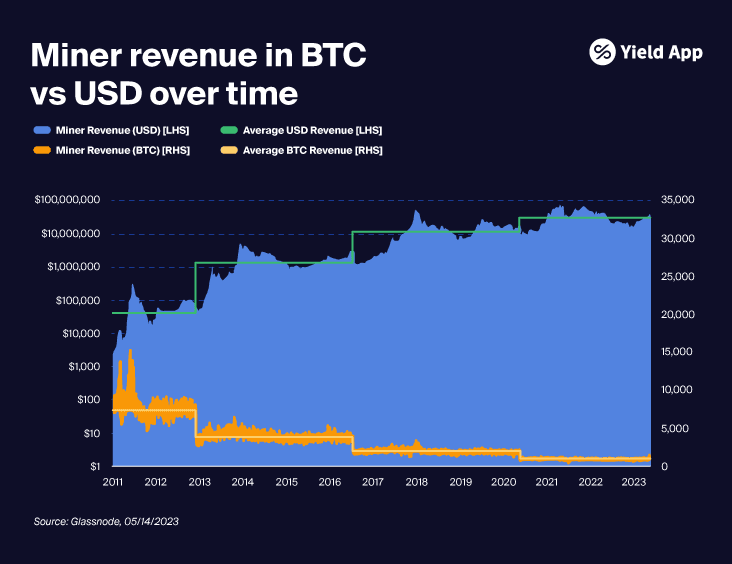

Less bitcoin, but more cash: Soaring miner rewards

These rewards soared to $27,500 when BTC reached $1,100 by the end of the following year. When the next halving occurred on 9 July 2016, the asset’s price had retreated somewhat from these highs and 12.5 BTC was worth around $8,125.

However, the 2020 halving, which took place on 11 May, saw one BTC priced at around $8,600 – meaning miners were earning $53,750 for each validated block.

As such, despite the rewards being halved in BTC terms, miners are earning more per block than they were in the early days of Bitcoin. With bitcoin currently priced at around $37,000, miners are earning $231,250 per block, before costs or gross.

However, the overall costs have also increased, including the power and machines needed for the increasingly complex computations required to mine bitcoins. As a result of this, market downturns such as the one the market experienced in the last 18 months have created a real drag on miners’ profitability.

Source: https://www.fidelitydigitalassets.com/research-and-insights/understanding-bitcoin-halving

Source: https://www.fidelitydigitalassets.com/research-and-insights/understanding-bitcoin-halving

The upcoming halving in 2024 will see these rewards halved again to 3.125 BTC, while the next event in 2028 will further slash these to 1.5625 BTC. However, if bitcoin’s price continues to rise, miners can reasonably expect their revenues to keep increasing in US dollar terms.

The impact of Bitcoin halvings on price

The main role of Bitcoin halvings is to reduce the supply of new bitcoins going into circulation, thereby creating scarcity in the market. With the total supply of bitcoin capped at 21 million coins, this automatically pushes up the price of one BTC over time.

On top of this, as the rate of issuance decreases over time, it becomes progressively harder to mine new bitcoins, which aligns with the economic principle of scarcity to maintain value. In turn, this reduction in supply has historically tended to drive up demand, leading to bitcoin price rallies following the halving events.

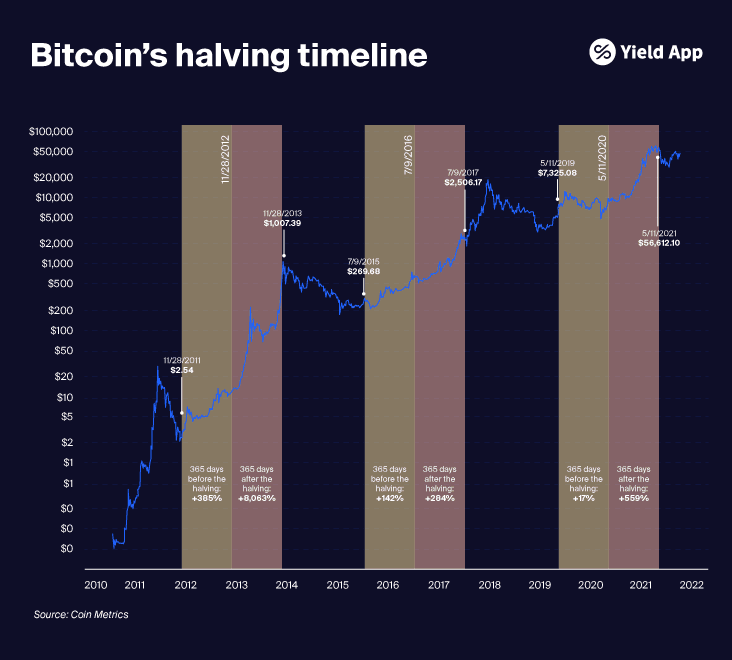

In fact, bitcoin experienced significant price appreciation within a year of each of the previous halvings. The 365 days after the first halving in November 2012 saw the price skyrocket by some 8,069% to $1,007.39 by 28 November 2013. But this was just the beginning.

A year after the second halving in July 2016, BTC soared 284% to $2,506.17. The crypto asset continued its rise for the rest of the year, hitting a high of nearly $20,000 by December 2017 – a whopping increase of nearly 3,000%.

Similarly, one year on from its latest halving in 2020, bitcoin soared by 559% to a price of $56,612.10 (as of 11 May 2021). However, it wasn’t until 10 November 2021 – six months later – that it hit its all-time high of $69,044.77.

Down in the doldrums: The 2022 crypto winter

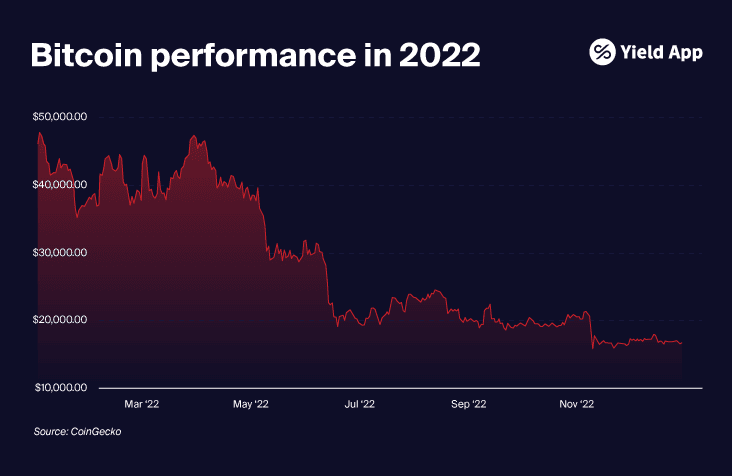

Now, trading just above $37,000 at the time of writing, bitcoin remains more than 45% below this all-time high, despite enjoying a strong recovery in 2023.

Last year, the collapse of the Terra/Luna ecosystem in May 2022 set off a domino effect that initiated a crypto winter, where all digital assets suffered. Bitcoin’s price fell below $30,000 in June 2022 and collapsed to its cycle-low of less than $16,000 after the fall of the FTX exchange in November.

The events of last year heavily affected investor confidence, decimating transaction volumes and driving down asset prices across the spectrum. The capitalization of the crypto market dropped below $1 trillion from around $2,5 trillion at its peak in 2021.

Life after the 2024 halving: Outlook for bitcoin

As sentiment improves, it’s important to keep in mind that the implications of 2022 will be far-reaching and may continue to affect confidence and investment in Web3 space. In 2023, leading exchanges Binance, Coinbase, and Kraken have all faced a regulatory crackdown in the US, while financial watchdogs across the globe are also taking a more active stance in the regulation of the crypto market.

Equally, while the US economy has weathered the interest-rate hiking cycle well so far, GDP growth may begin to slow down in 2024. Coupled with geopolitical unrest, this could also be a headwind for risk asset prices next year.

At the same time, however, bitcoin may enjoy strong support in early 2024 if the Securities and Exchange Commission (SEC) finally approves the first US spot bitcoin ETF. This news could help propel BTC to a new high, with several market analysts predicting a rise beyond $100,000.

Key takeaway

The eagerly anticipated bitcoin halving event, expected around May 2024, will reduce the rewards bitcoin miners earn in half, thereby curbing the issuance of new bitcoins onto the market and promoting scarcity.

Historically, this has led to major price rallies within a year of the event, with bitcoin typically hitting a new all-time high within 18 months. This has resulted in many market commentators predicting another major bitcoin rally after next year’s halving.

However, past performance should never be considered an indicator of future performance and there are other factors in play that could affect investor sentiment in a positive or negative way.

While the approval of a spot BTC ETF in the US could be the catalyst for a rally, regulatory pressures could emerge as headwinds for bitcoin. As such, investors should always exercise caution when investing in digital assets and be mindful of their inherent volatility.

Want to earn a yield on your BTC? Open a Yield App account today!

Learn more

Learn more