Welcome to the final part of our series on crypto structured products. In this article, we'll shed light on some of the risks and rewards associated with crypto structured products.

During this series, we've debunked some common misconceptions surrounding crypto structured products, and delved into the current landscape of these innovative investment vehicles.

In this final piece, we cover the possible risks and rewards linked to these investment products. By examining the potential gains, potential drawbacks, and strategies to balance risk and reward effectively, we hope to equip you with the insights needed to navigate this intricate yet potentially rewarding financial asset class.

Potential benefits of crypto structured products

Crypto structured products offer several advantages, such as:

Portfolio diversification

Diversification is an investment strategy that helps reduce risk by spreading investments across different financial instruments, industries, and other categories. Investing in crypto structured products can help diversify your portfolio, provide broader exposure to digital assets, and could improve your risk-adjusted returns.

High potential returns

Crypto markets, known for their volatility, can drive significant returns. By trading and monetizing this volatility through structured products, investors can tap into potential gains, and potentially safeguard against downside risks.

Accessibility and democratization

Cryptocurrencies have ushered in a new era of financial democratization through their accessibility. Crypto structured products, once exclusive to seasoned investors, now offer high-yield investment opportunities to a broader audience, effectively leveling the playing field in finance.

Potential pitfalls of crypto structured products

Despite the potential benefits, investors should remain vigilant about the challenges such as:

Market volatility

While volatility can result in high returns, it can also lead to significant losses. Cryptocurrency prices can see rapid swings within a short span, resulting in sudden changes in the value of crypto structured products.

Regulatory uncertainty

As regulatory guidelines for cryptocurrencies continue to evolve, these changes can impact the value and legality of some crypto structured products. Therefore, investors must keep abreast of regulatory changes and remain adaptable to avoid potential legal pitfalls and unexpected shifts in investment value.

Technological complexity and associated risks

The complex blockchain technology and smart contracts that underpin crypto structured products can pose potential challenges, including operational issues, security vulnerabilities, and other technology-related risks. Although these risks are rare, they - along with traditional counterparty credit risk - could adversely affect a crypto structured product.

Balancing risks and rewards with crypto structured products

The art of successful investing resides in balancing the risks with the potential rewards. Crypto structured products, through the strategic use of options, futures, and asset pair combinations, can help mitigate risk while maximizing the potential for attractive returns.

Understanding volatility, performing due diligence, and continuous learning are also vital. While understanding potential benefits is important, acknowledging and effectively managing the associated risks is equally critical.

Case studies

Here are two case studies highlighting the potential risks and rewards associated with investing in crypto structured products:

Case study 1

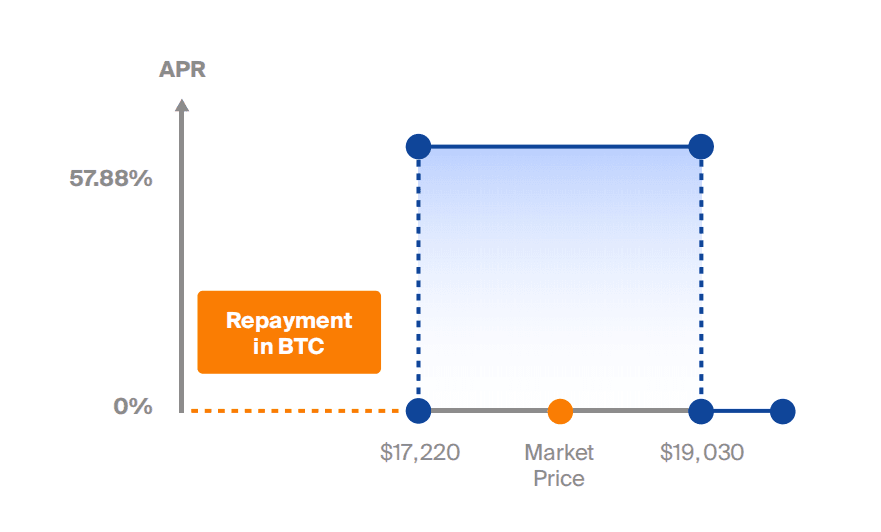

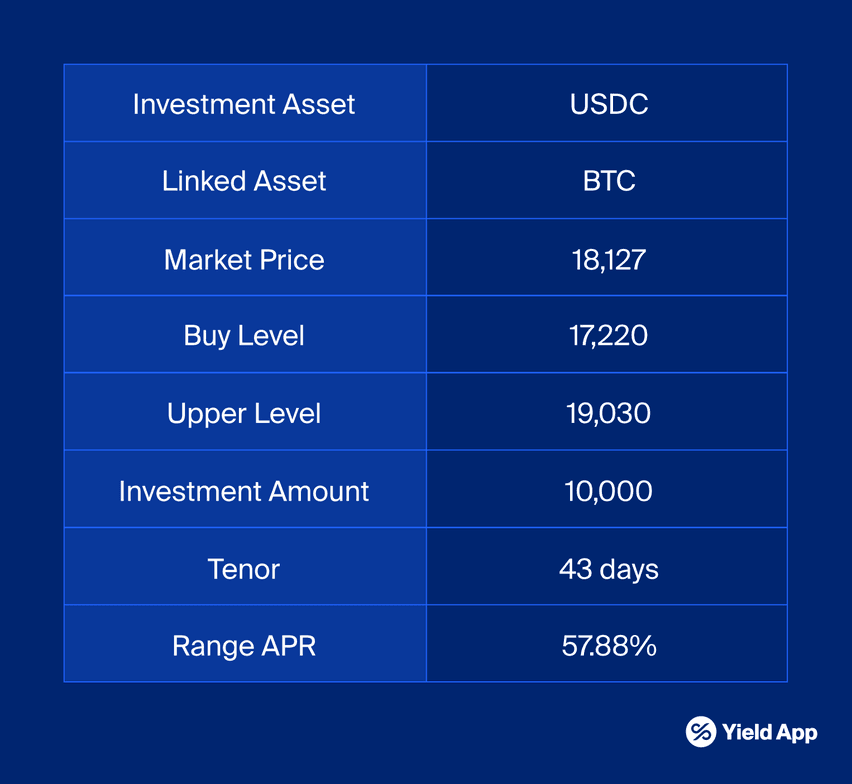

To illustrate a potential best-case scenario with crypto structured products, we'll use an example featuring Yield Pro’s Range product:

Image: Yield Pro (Range)

If BTC settles between $17,200 and $19,030 at maturity, you’ll get back your principal investment in USDC plus the APR of 57.88%. This is the best case scenario for this product.

In this example, the final payout is:

Coupon payment for 43 days: 57.88 x (43/365) = 6.82%

Total payout: 10,000 USDC + (10,000 USDC x 6.82%) = 10,682 USDC

Net return: 10,000 USDC x 6.82% = 682 USDC

Case study 2

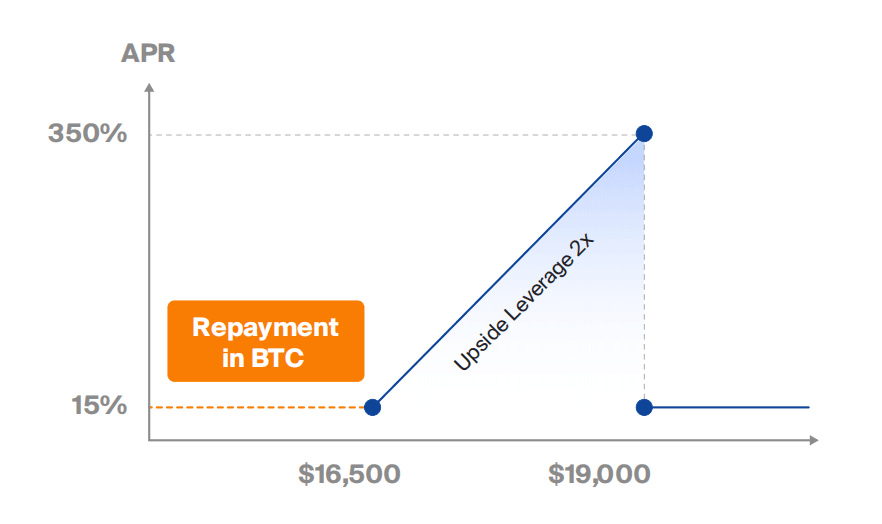

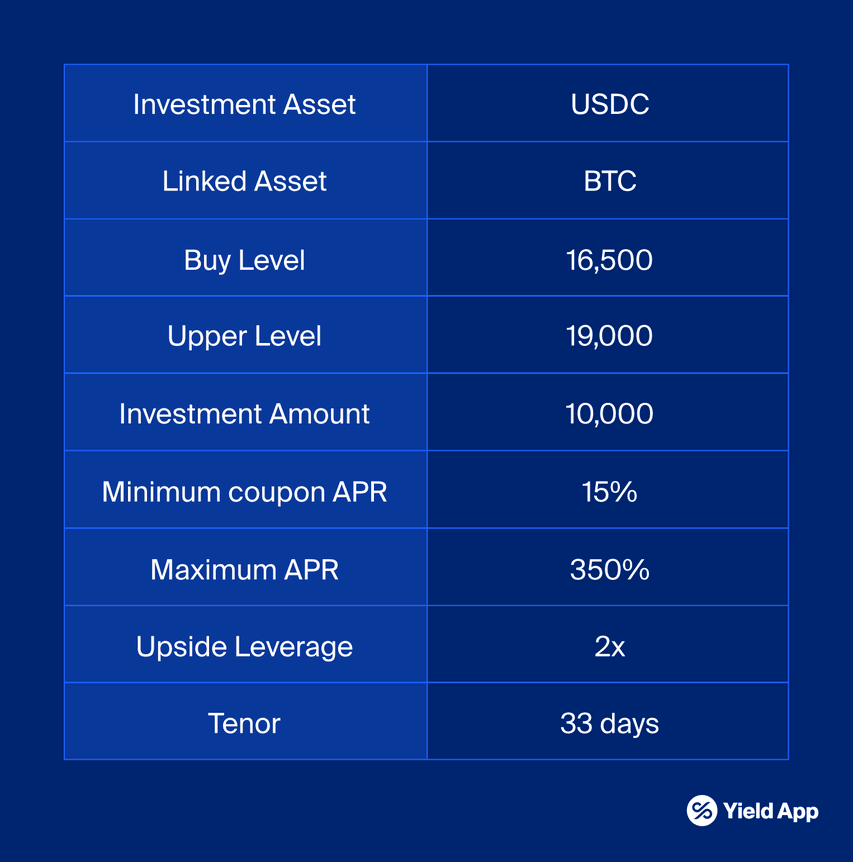

To illustrate a potential downside risk scenario in investing in crypto structured products, we'll use an example featuring Yield Pro’s Sharkfin product:

Image: Yield Pro (Sharkfin)

In this scenario, if BTC settles at $15,500, the final payout is:

Coupon payment for 33 days: 15% x (33/365) = 1.36%

10,000 USDC + (10,000 USDC x 1.36%) = 10,136 USDC

10,136 USDC invested in BTC at $16,500 = 0.6143 BTC

In USDC terms, your BTC holding will only be worth 0.6143 BTC x $15,500 = 9,521.70 USDC. If you were to sell your BTC for USDC at this point, you would suffer a net loss of 478.30 USDC.

However, you could also hold on to BTC and sell at a later date when and if the price recovers.

Conclusion

Crypto structured products, with the potential for high returns and portfolio diversification, present an intriguing investment option. But they do come with their own set of risks. Knowledgeable risk management, however, can turn these challenges into stepping stones.

Through this series, we've debunk some common myths, explored some of the realities, and offered a balanced view of typical risks and rewards related to crypto structured products. We hope this empowers you to make more informed decisions on your crypto investment journey.

Unleash your investment potential with Yield Pro Simulator. Download the app on Android and iOS to get started!

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.

Learn more

Learn more