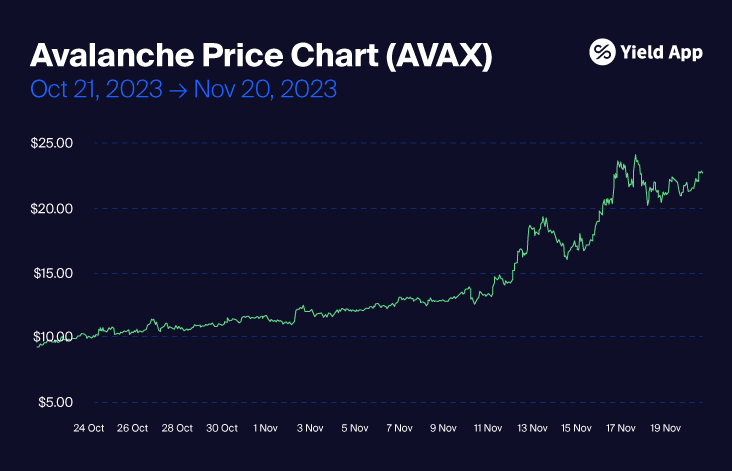

In recent weeks, AVAX – the native token of the Avalanche blockchain – has witnessed a remarkable rebound. Over the past 30 days to 20 November 2023, the token has soared 148% to trade around the $22.65 mark.

While some of this rally resulted from the growing optimism for an imminent spot bitcoin ETF approval by the Securities and Exchange Commission (SEC), which lifted the digital asset market as a whole, several positive news headlines propelled Avalanche higher than many of its competitors. Let’s dig into the drivers behind Avalanche’s recent runaway success.

Back to basics: The early days of AVAX

Avalanche, a decentralized, proof-of-stake blockchain platform, was launched in September 2020 by Emin Gun Sirer, the CEO of Ava Labs. The blockchain focuses on scalability, speed, and interoperability, with the aim to tackle the inherent issues faced by existing blockchains like Bitcoin and Ethereum.

Find out how much you could earn on XRP with Yield App!

It was built using the unique Avalanche Consensus mechanism, which enabled rapid transaction finality, achieving high throughput with up to 4,500 transactions per second (TPS) compared to Ethereum's 15 TPS, and relatively low transaction fees. Its native token, AVAX, quickly gained traction, soaring in value by over 3,000% in the first year.

Towards the end of 2021, the token’s value was further supported by Ava Labs’ partnership with Mastercard, as well as a Bank of America (BofA) report that touted Avalanche as a viable alternative to Ethereum. On 21 November 2021, AVAX reached its all-time high of $144.96.

Avalanche plummets into Crypto Winter

However, amid the crypto market downturn that started in May 2022, the token quickly plummeted, hitting a low of $10.87 by the end of the year. For the most part, AVAX’s price remained subdued until November 2023, save for a short-lived rally that followed a partnership announcement between Ava Labs and Amazon Web Services in January 2023.

Its eventual resurgence began in October 2023, with the launch of decentralized social media (DeSo) application Stars Arena, built using Avalanche’s Contract Chain (C-Chain). At the time, the platform attracted significant attention. On 6 October, its transaction volume jumped to nearly $5 million, according to DappRadar, though this has since petered off as the hype around DeSo apps gradually cooled.

AVAX’s thawing fortunes

However, this was only the start of AVAX’s rally, as several positive headlines helped the token soar to fresh 2023 highs. Last week brought several headlines that were particularly instrumental in thawing out the Crypto Winter.

On Thursday, 16 November, news emerged that Avalanche’s permissioned subnet had been selected by JP Morgan and Apollo Global's blockchain platform, Onyx, as part of a proof-of-concept under the Monetary Authority of Singapore's Project Guardian.

This pilot scheme aims to demonstrate the value of tokenization for traditional portfolio management. This could pave the way to mainstream adoption of crypto technology in the global asset management industry, which currently has around $100 trillion in assets under management (AUM).

READ: XRP’s revival: Is the sleeping giant finally stirring?

A day after this announcement, tech firm Republic selected Avalanche to host its profit-sharing tokenized security, the Republic Note (R/Note). Slated for launch in December, the R/Note will distribute stablecoin dividends to investors in Republic’s venture capital portfolio of around 750 “private assets”.

Andrew Durgee, head of Republic Crypto, told CoinDesk that Avalanche boasts “innate features” that other blockchains don’t offer, such as the ability to set up highly customizable side chains called “subnets”. Indeed, Avalanche has been heavily focused on building out these subnets for the GameFi sector, responding to growing demand.

Republic also praised Avalanche for its scalability and speed, its eco-friendly design, and a shared commitment to building a more inclusive financial future through tokenization. Driven by this slew of positive headlines, AVAX’s price has soared by 85% over the last seven days alone.

Will AVAX climb to new peaks in 2023?

From a trough of $8.91 on 19 October 2023, the AVAX token has seen a remarkable recovery over the past 30 days driven by an avalanche of positive news headlines. However, the question now is whether AVAX will hold at current support levels and soar to new highs, or plummet once again as investors begin to take profits.

READ: Wait, how can Yield App pay up to 11 % APY?

In the near future, analysts see promise in the rapid recovery of the GameFi sector, with Avalanche’s newly-launched Gaming subnets poised to drive the blockchain’s adoption. Avalanche burns 100% of the revenue it generates from transaction fees, so a spike in network transactions naturally spurs the AVAX rally. With new Shrapnel and Loco Legends subnets expected to go live soon, this could offer further support for the token.

According to TradingView, if AVAX rises above the $24.50 and $25 resistance levels, it could see another 20% surge to $30 – a price not seen since May 2022. However, a fall below $20.50 could mean a slide to $18. As ever with altcoins, investors must be prepared for heightened volatility, especially amid the tentative crypto market recovery that is currently highly dependent on the SEC’s bitcoin ETF decision.

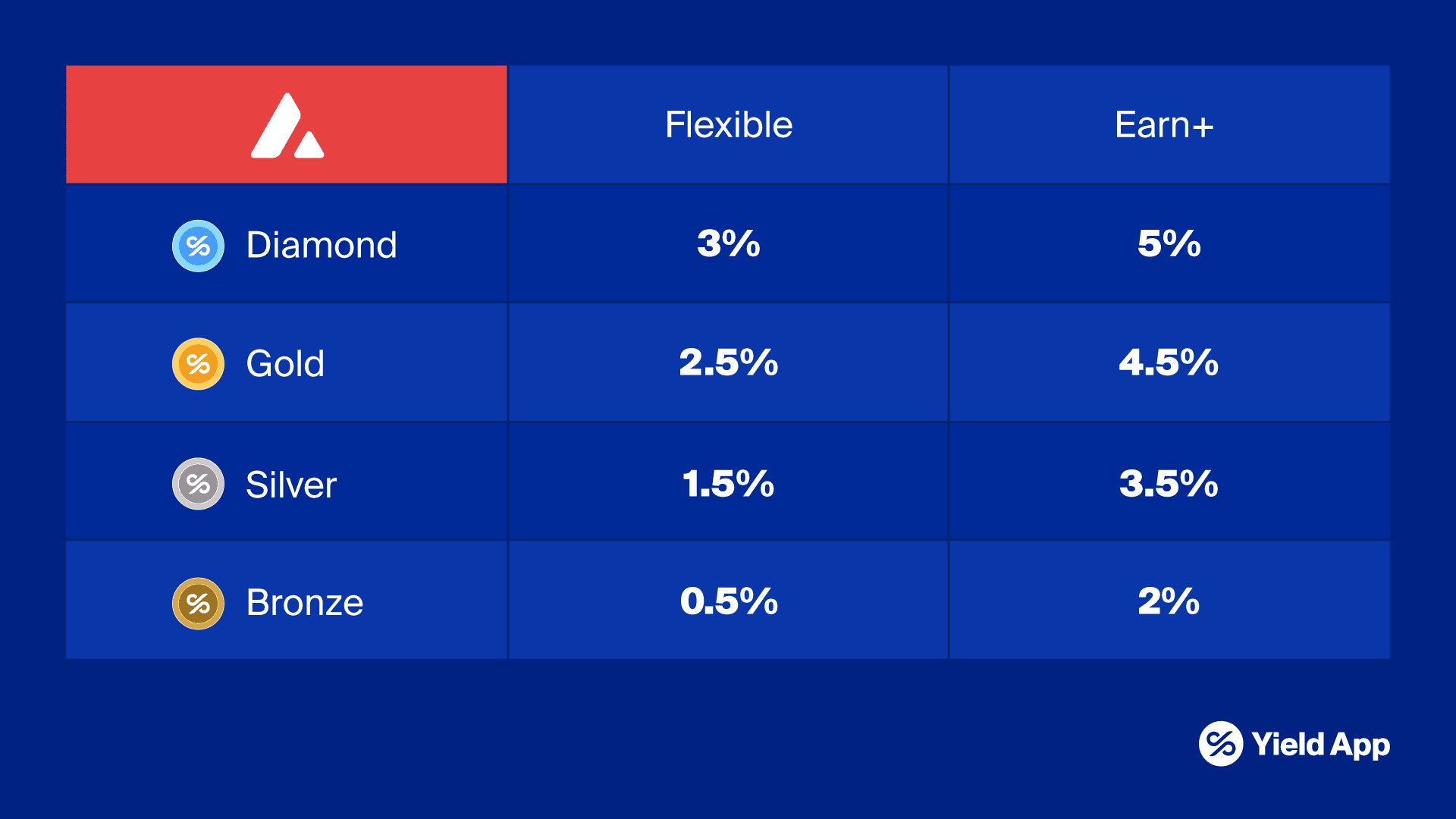

However, if you already hold AVAX or have recently invested for the first time, why not make this token work harder for you? You could earn up to 5% p.a. on AVAX with Yield App!

Want to make the most of your crypto? Open a Yield App account today

Learn more

Learn more